The launch of Atom Bank has certainly had its fair share of hype. Talk of the lender’s launch into the intermediary mortgage market began in June last year when the firm secured its banking license and it has been steadily gearing up with a number of partnerships since.

But for an industry so set in its ways, how does a mortgage lender with such a modern business sense and unique proposition convince the intermediary market that it’s a serious player?

Harris says the bank has worked tirelessly with brokers to create a service and product range that identifies gaps in the market while addressing some of the industry’s age old problems. Products will initially be distributed through Legal & General’s key account firms alongside LSL networks Pink and First Complete, with plans to broaden distribution over time.

Atom’s residential range is tailored to support the self-employed, contractors, lending into retirement, shared ownership, first-time-buyers and purchasers of new-build properties. It will launch buy-to-let in the new year, with the bank keeping a close eye on the market before it leaps in with a range of mortgage deals.

Joining up the dots

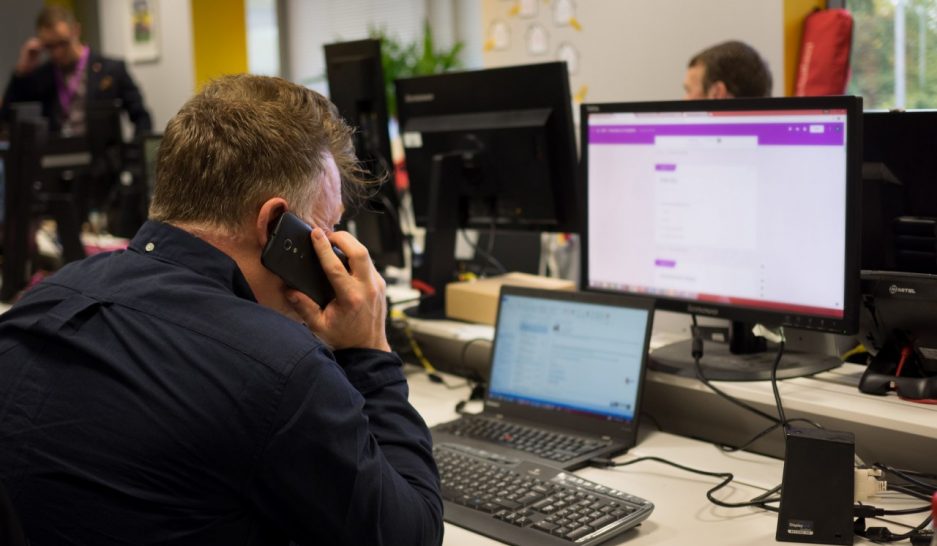

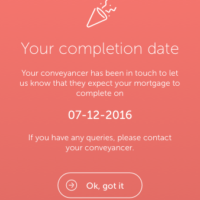

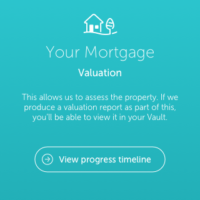

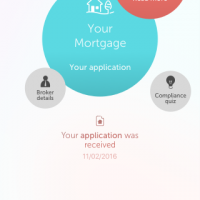

Atom operates through an app which the mortgage customer will download on a smartphone device or tablet intended to hand the consumer as much self-service as possible. The broker, however, will use all the usual channels – website, telephone and face-to-face augmented by social media chat services, like Twitter or LinkedIn.

Harris is under no illusion that the broker industry is ready to make the leap to a fully digitised mortgage market.

“For the consumer, I think we’ve set out what we intended to achieve. But on the intermediary side there are still bits where the industry is not quite ready for digital yet. So we’ve digitised the bits that we can but there’s some bits that we still want to do.”

Valuations and conveyancing are two key areas that Harris says are in dire need of development to speed up the mortgage time to offer.

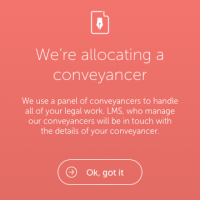

Atom Bank has teamed up with LMS for its conveyancing panel management and Legal and General for property valuations; both firms were selected due to propositions that allow the bank to keep processes as automated as possible.

But Harris explains that the bank has done its best to keep most functions in-house, with underwriting, compliance, customer-facing channels, loan servicing and accounts all managed by Atom’s employees and internal systems based in its head office in Durham.

“As a new lender you have to be quite close to how you manage your risk and things like panels,” she says. “We’re not big enough to have conveyancing panel management in house and our ethos about being low cost and using the best of what’s available outside of what we have is to use the people that are experts in their field.”

Do-it-yourself banking

Arguably one of the most important principles that sits behind behind Atom Bank’s offering is giving customers the knowledge and responsibility to make the right financial decisions. Indeed, Harris explains that as the entire bank is contained within an app, customers are required to take control of the experience, instead of walking into a branch.

Customers do have access to a 24/7 servicing team, but Harris is clear this is does not operate as a transactional contact centre and is there to help the customer “do what they want to do, but not do it for them”. For brokers, Atom’s team of seven BDMs will be on hand and its Twitter channel is monitored 24/7. The contact centre which looks after customers will also take calls from brokers. “The system is truly 24/7, 365 days a year,” Harris says.

So, with such a do-it-yourself ethic at the centre of Atom’s business strategy, why did the lender choose to make its mortgage range available only through intermediaries?

“We think the mortgage decision is a complicated one, so an intermediary in that process is really important and the person best placed to give the customer fair, impartial and whole of market advice,” Harris says.

“That means the customer gets the right outcome, even if that outcome is not to come to us. We don’t want to do advice in-house because you can only advise on your own products and I’m not sure that fits with our view that customers should have access to the best advice.”

Click the images above to enlarge

But the lender is aware that some customers will expect an element of self-service in their mortgage application in the same way they transact with their savings and current accounts. Harris says that this is where execution-only services could help in the future.

“Part of the expectation that our customers will be able to self-serve means there will be some who expect they can self-serve their own mortgage. Whether that means retention or remortgaging, that’s something we’ll have to work on with our customers on how best to fulfil that need.

“Some of our existing customers will absolutely expect it, but whether we do it for new customers is something to think about.”

But for now, brokers will benefit from retention business through Atom exactly as they will with acquisition; with access to the same system, process, service, and procuration fee.

Technology will aid this, as the customer app stores the intermediary’s details within it so the customer can go back at any time and contact them with ease.

Challenging the status quo

As a lender with such a technology-focused proposition, think Atom had to overcome a number of regulatory obstacles in the lead up to launch.

However, Harris explains that the capital requirements involved in setting up a challenger bank were far bigger hurdles than the technology.

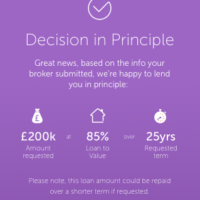

“Trying to get your capital set up 1) to be live, but 2) to then be able to price competitively, grow your business and then compete against the big banks, is a huge challenge for a start-up,” she explains. “The amount of capital that we have to hold for every pound of mortgages we lend is huge compared to what a big bank needs to hold, which will be the case for a minimum of three years. Under standardised capital we have to hold 35% and for banks operating under the Internal based rating system could be holding as little as 8% in a low-LTV mortgage.

“You have to be competitive in order for an intermediary to advise on you in the first place and those funding constraints make being competitive even harder. To price that, the only place you can go is margin; which is why the big six are still the big six and why all the new lenders tend to do specialist,” Harris adds.

So what kinds of lending plans does the bank have? Harris won’t drawn on specific amounts but is clear about the Bank’s ambitions. Despite being new to the market, Atom wants to be seen as a mainstream challenger, but with a proposition that Harris believes addresses some of the gaps in the market.

“The whole point of being a challenger is to take on the market and do something different. You want to be big enough to be making some noise,” Harris concludes.

“We can only be as big as our capital allows us to be, but trust and reputation are a main priority. Transparency is really important, it’s about focusing less on products and proposition and more on the customer.”

Atom’s mortgage criteria at a glance

- Residential remortgage and purchase

- Maximum age at the end of the term is 80

- Maximum term is 35 years

- Maximum loan size £2m

- Shared ownership up to 95% LTV

- New build houses up to 85% LTV

- SVR at 3.75%