We welcome Nationwide’s decision to replace its free legal service in favour of offering clients cashback.

Its decision has to be applauded as it clearly shows they are putting the customer first by developing a product that allows the client to choose a conveyancer that will deliver the right service and customer experience.

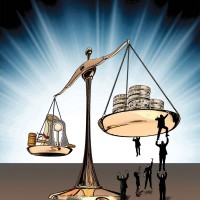

We are calling for all lenders to provide consumers with more choice when remortgaging, whether that is by offering a cashback option or an alternative.

That is not to say free legal products are necessarily bad but they have been over-commoditised and there is a lack of capacity and under investment in the customer journey.

Lack of planning

Many may challenge this, but the focus has been on cost reduction at the cost of customer experience, especially when that includes a lack of investment as consumer behaviours continue to change.

In defence of some law firms who play in this area, they simply cannot afford to deliver the right service or investment for the fee they are paid to deliver it – often relying on additional fees to make up margin, which again can be detrimental for the borrower.

It is also true to say that while in any industry it is very difficult to manage the peaks and troughs, the remortgage market volume has been increasing for some time, so much of the issue must be down to a lack of strategic planning or action.

Conveyancing firm Breezeplus and LMS panel member QCAS are among the main players to have been caught up in the problems which have beset the industry.

Lenders’ responsibility

It is also fair to say that some lenders have managed the situation better than others.

It is possible that lenders thought the increase in availability of product transfers would have reduced the remortgage volume and logic suggests it would.

But it is good to see that brokers are not falling for the easy option and continuing to give customers proper advice that often means the remortgage is a better option.

However, I would urge brokers to ensure their customers do not jump out of the pan into the fire.

Broker role

Taking cashback and allowing their client to select a solicitor who is not well versed in conveyancing could prove costly, as well as painful, and that is why the role that the broker plays is so critical.

It is also why it’s absolutely right that brokers are remunerated appropriately for the part they play.

This is why we allow them interaction with the case and why we have an inclusive and transparent remortgage fee of £299 with a £100 referral fee for the broker.

Ultimately, the recent pain clients and brokers have suffered on free legal remortgage cases will not be in vain as I believe we will go through a market correction, which will fall in favour of the consumer and reward the broker for the key role they play.