The total number was 8% higher than 2016 – itself a year of strong growth – and marks the strongest annual performance in more than a decade.

At more than £59bn, the value of mortgage loans advanced to first-time buyers represents a new record high, for the second year in a row.

As well as bringing a strong sense of well-being to those becoming home owners, first-time buyers provide a key source of liquidity for the wider housing market and are vital to its overall health and dynamism.

So, there is much to celebrate in these figures.

But, at the same time as welcoming such developments, we should be careful to avoid complacency.

If we look behind the headline figures, then we realise that things are not quite as positive as they first appear. (Click graph to expand.)

In a very real sense, the difficult years of the global financial crisis – characterised by the collapse in higher LTV lending – and the slow recovery of the post-crisis period have blunted our expectations as to what a strong outturn looks like.

A figure of 366,000 represents a near-doubling from the post-crisis lows of less than 200,000 reported over the 2008-11 period.

But such a performance is less impressive, when judged against the fact that first-time buyers comfortably averaged more than 400,000 per annum for the 30 years preceding the crisis.

Given the demographics are still highly favourable, with near-record numbers of under-40s – comprising the age cohorts most likely to become home-owners – a baseline figure in the 400,000-450,000 range would seem a more appropriate benchmark to gauge satisfactory performance.

With few anticipating a return to such levels anytime soon, stakeholders share a significant challenge and there do not appear to be any easy remedies.

Affordability

As most of us know, a range of factors have been bearing down on first-time buyer numbers for a long while, and in some cases since the early-to-mid 1990s.

These include, but are not limited to:

- greater participation in higher education,

- lifestyle choices,

- greater choice in the private rented sector,

- higher numbers of young inward migrants less likely to buy,

- and high and rising house prices.

Affordability pressures represent some of the most obvious and persistent headwinds for prospective first-time buyers.

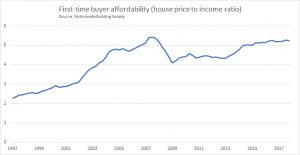

There are many ways to think about affordability, but here, our focus is on the basic relationship between house prices and household incomes or earnings.

Whichever particular metrics we use, it is clear that the position has deteriorated profoundly over time.

Broadly speaking, the housing affordability ratio has doubled over the past 20 years, that is households now have to commit double the multiple of earnings when purchasing a home.

Pre-credit crisis deterioration

Much of this deterioration took place in the decade leading up to the credit crisis. (Click graph below to expand.)

Lower interest rates, made possible by the taming of inflationary pressures, was one of the key drivers, as this meant that larger mortgages could be serviced from a given level of income, allowing households to bid up house prices.

Trends reversed sharply in the wake of the credit crisis, but any respite was short-lived. Affordability pressures have resurfaced over the past few years, and in some parts of the country have intensified to record levels.

Fortunately, better mortgage credit availability, alongside a revival in lenders’ credit risk appetites and stronger competition for new business, has meant progressively lower mortgage rates.

This has, for the time being at least, helped to offset any negative impact on monthly mortgage bills or the ability of households to service them.

So, while most mortgages currently appear to be “affordable”, we should not lose sight of the fact that the divergence between house prices and earnings means that deposit constraints have acted as a severe brake for those wishing to get on the property ladder over the past decade.

90% of gross income

Although precise calculations are not possible, UK Finance metrics suggest that a typical first-time buyer still needs to put down a deposit that is equivalent to about 90% of their gross income, a proportion that does not appear to have eased over recent years.

If figures based on those who have succeeded to get on the property ladder show ongoing challenges around deposits, it does not require a great leap of the imagination to infer that the ability (or not) of households to raise a sufficient deposit plays a big part in determining who gets onto the housing ladder.

No surprise, then, that for the past seven years, raising a deposit has consistently been seen as the biggest obstacle to purchasing a home, according to the Building Societies Association’s (BSA) Property Tracker. (Click graph below to expand.)

We do of course need to recognise that, as for so many aspects of the housing market, there is considerable variation according to geography.

There are material challenges for those wishing to buy in London, and to a lesser extent the South East, and these deposit constraints look no less challenging than five years ago.

Elsewhere, the picture is more mixed, with less elevated local housing markets and signs of constraints easing to some degree in Scotland, Wales and Northern Ireland, but not really across the English regions.

In the second part of his first-time buyer analysis, Bob Pannell considers what the future holds and how government policy will impact potential homeowners.