Data published by chartered surveyor esurv showed that the average number of monthly approvals rose steadily in the second half of the year, up from 64,047 in H1 2015. However, approvals fell by 3.1% to 68,218 in December, likely due to supply issues, higher prices and new legislation.

Richard Sexton, director at esurv, said: “House purchase lending has been rejuvenated over the past year and with the second half of 2015 looking stronger than the first in lending terms, the trend looks positive.

“Supply issues have become more of a factor in some areas, as both growing demand and house prices finally get the attention they deserve from the government.”

He added that a limited choice of affordable homes is proving a challenge to some buyers.

| Month | Number | Monthly change | Annual change |

| July | 68,906 | +2.7% | +5.5% |

| August | 70,864 | +2.8% | +12.6% |

| September | 69,168 | -2.4% | +13.2% |

| October | 69,867 | +1.0% | +17.6% |

| November | 70,410 | +0.8% | +18.8% |

| December | 68,218 | -3.1% | +12.5% |

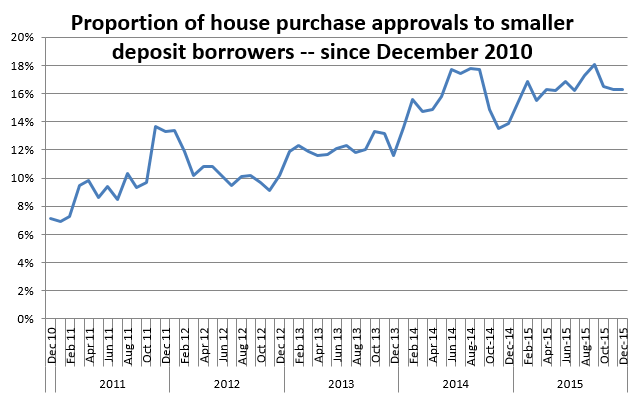

Small-deposit lending has been transformed by a renewed enthusiasm to help first-time buyers cross the threshold of homeownership.

Small-deposit lending to buyers with deposits of less than 15% stood at the same proportion as the month before, totalling 16.3% of total house purchase approvals.

“Figures suggest that small-deposit lending has slowed towards the end of the year compared to H1, but year-on-year numbers are up as first-time buyers have increasingly been seen as valuable customers by the lending industry. These first-timers still need help though, and initiatives tackling supply are a crucial first step,” said Sexton.