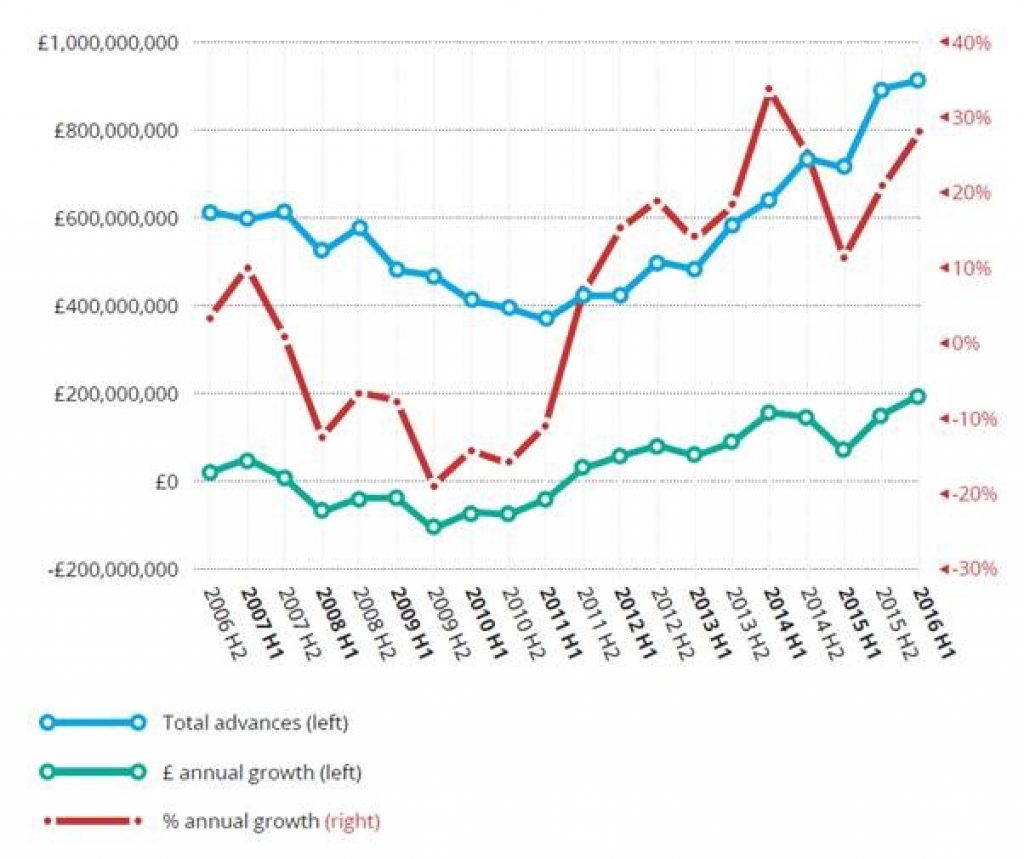

It reported annual growth of £198m in equity release lending between the first halves of 2015 and 2016, the highest in a decade, surpassing the £160m figure for H1 in 2014.

This is a sign consumers are increasingly releasing housing wealth in a bid to fund lifestyles in later life. Lending in the second quarter of 2016 exceeded £500m for the first time.

Reasons for the increase are being put down to increased choice in the market as research by Moneyfacts in March found the range of equity release products has grown by 34% year-on-year.

Increased choice has also led to a positive impact on pricing. Average lifetime mortgage rates fell by 24 basis points, more so than any other category, and reached 5.96% in July with an increase in sub-5% rates available.

The report also found drawdown mortgages remain the most popular choice in the face of increased options. Drawdown represented 67% new plans in H1 2016, in keeping with the pattern of at least 65% of new plans being drawdown.

The average age of customers continued to hover below 70, with the 56-74 age bracket remaining the most common for taking out a new plan. This is believed to be a sign of people looking at housing wealth as an asset to support early retirement planning.

Chairman of The Equity Release council, Nigel Waterson, commented on the findings: “Growth is being driven by a combination of rising consumer demand and continuing signs of innovation and change in the market. In terms of demand, savings shortfalls and other financial challenges leave many over-55s looking for an extra source of income in later life, while housing wealth also offers a vehicle for inter-generational transfer of wealth and inheritance planning.”

As the market continues to grow there has been a call for better expert advice to be readily available to consumers as people become aware of using property wealth to support retirement planning.

Andrea Rozario, chief corporate officer at Bower Retirement, said: “The market has been evolving, improving and becoming more cost-effective than ever before underlining the need for expert independent advice for consumers and the benefits for advisers in working in the sector.”