The figures released as part of Rightmove’s Q3 Rental Trends Tracker showed new rental listings were also 6% higher compared to the same quarter in 2015.

Sam Mitchell, head of lettings at Rightmove, said: “Investor activity has bounced back following the stamp duty changes, though some agents report that many investors are looking to knock sellers down on asking prices to make up for the additional stamp duty they now need to pay.”

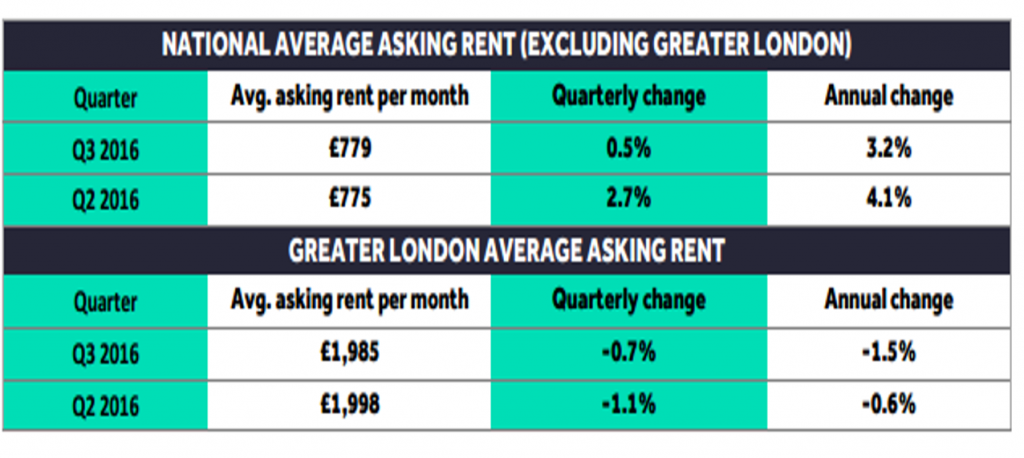

Additionally, asking rents were up this quarter at 0.5% to £779 per month. The North-West rose the most this quarter, up 2.0% with Scotland directly behind with 1.5%.

The rush to beat the stamp duty changes during Q1 paid off for investors outside London with many of them buying into seaside properties including Southend-on-Sea and St Leonards-on-Sea. They saw average total returns of 14.7% and 13.7% respectively.

Meanwhile in London the highest returns were found in East Croydon (13.8%) and Greenford (13.4%).

Mitchell added: “Once again Essex and other commuter spots are offering investors the best total returns, and those looking at long-term investments are seeking out areas with upcoming improved transport links.

“The changes starting in 2017 to lessen mortgage interest tax relief may see some seriously review their businesses and could scale back, though there appears to be no signs yet of landlords exiting the market.”

Brian Murphy, head of lending for Mortgage Advice Bureau, said the findings by Rightmove were promising and gave a good indication of the state of the market since the Brexit result.

“The latest Rightmove data would suggest that the buy-to-let sector will remain stable, and providing current levels of stock and supply continues, for many landlords and investors both capital growth and rental incomes would appear to be maintaining strong momentum,” said Murphy.