Figures released by the Equity Release Council reported the total value of lending grew by 26% year-on-year to a record high of £571.6m in the third quarter of 2016.

This means the figure for total annual lending for 2016 is now on course to break the £2bn mark for the first time. The total lending for the first nine months reached 1.48bn- just £128m shy of 2015’s full year total of £1.61bn.

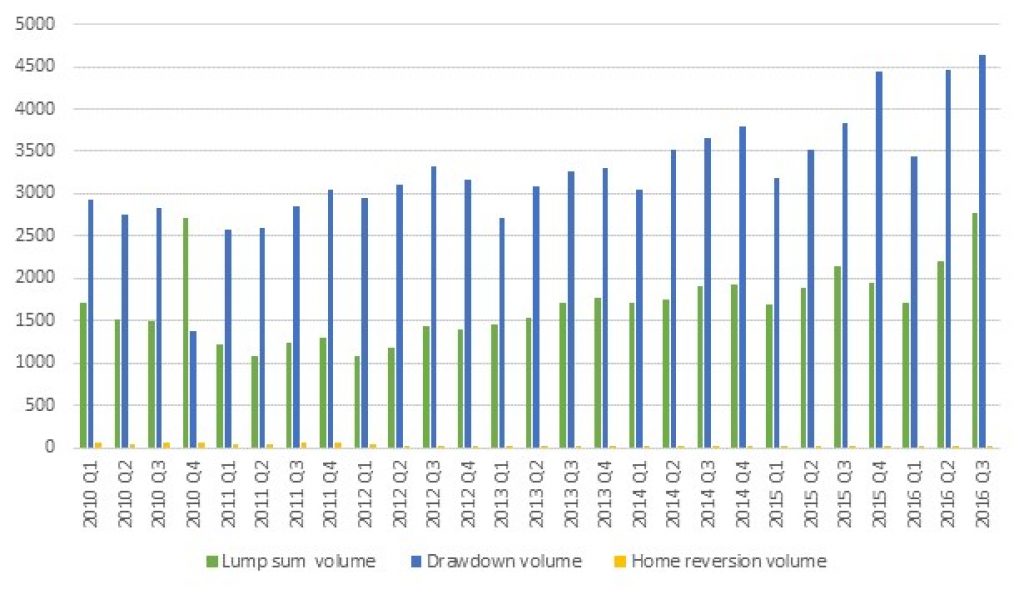

The figures showed that from July to September this year, 7,414 new equity release plans were taken out, highlighting an 11% increase from the previous quarter and up 23% year-on-year. It was also the first time the number of plans taken out exceeded the 7,000 mark since Q4 in 2008.

Lump sum lifetime mortgages, often used for one-off payments such as clearing outstanding mortgages, proved popular in Q3. There was a market share increase from 33% in Q2 to 37% in Q3, with 2,773 new plans agreed in the last quarter- the highest since Q4 2008.

Equity release plans agreed by quarter, 2010 to 2016

The total value of lump sum lending rose between Q2 and Q3 2016 from £208.8m to £264.1m highlighting a 44% increase year-on-year.

Steve Wilkie, managing director of Responsible Equity Release, commented on the figures saying they provided ‘cast iron proof that the equity release market couldn’t be in better health.’

He added that equity release has moved away from being seen as a means of redoing the family house or fund holidays.

“We are seeing some interesting new growth areas, such as a growing number of customers wishing to use equity release in a divorce settlement,” said Wilkie.

Nigel Waterson, chairman of the Equity Release Council, said the figures highlighted the appeal of using housing wealth as part of the solution to later life lending. He credited product innovation as one of the key factors in its growing popularity.

He said looking ahead that the council will continue to work with regulators, the government and people in the industry to promote the sector and its role in supporting an ageing population.