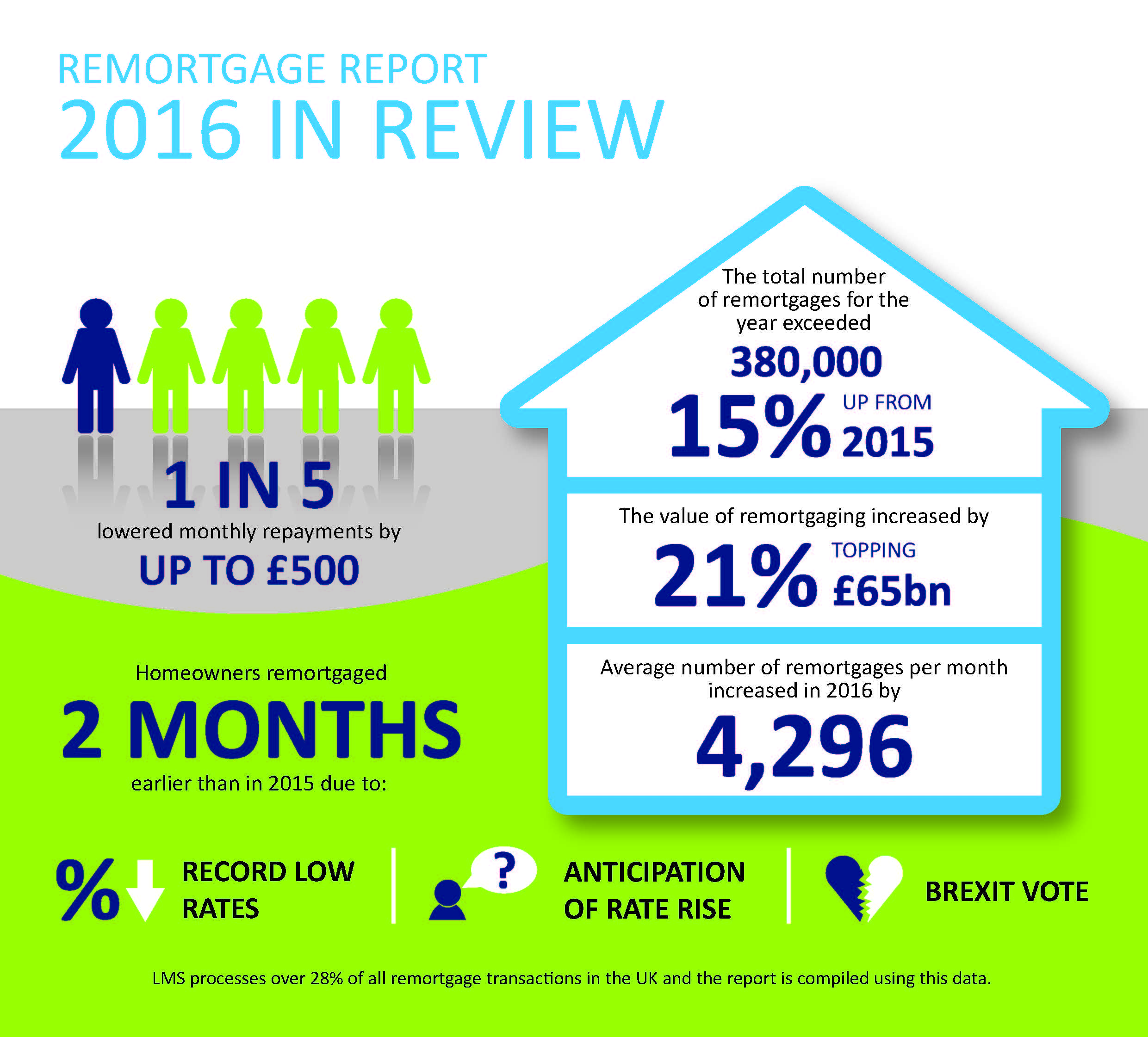

According to the LMS Remortgage Report, the total value of remortgage lending in 2016 topped £65.7bn, up £11.5bn on 2015 – an increase of 21%. The average monthly value of remortgaging was £5.5bn – £1bn more per month than the previous year.

The total number of remortgages in 2016 reached 384,950, an increase of 15% from 333,400 in 2015. LMS said that over the course of a year the difference is equal to almost 4,300 additional remortgages each month.

In November alone there were 36,850 remortgages, an annual increase of 21%, and the highest number since July 2009.

Andy Knee, LMS chief executive, said: “2016 has been a year of turbulence. But it has been a positive one for remortgaging, which bounced back from the slump it encountered in the wake of the 2008-2009 financial crisis, and is now 64% more valuable than in 2010.”

He added: “Remortgaging was driven by record low rates throughout the year, enabling homeowners to make substantial savings to their monthly outgoings. Anticipation of interest rate rises in recent months have also encouraged more people to remortgage with many opting to fix for longer.”

Ten year fixed rate mortgages are also becoming more popular as consumers seek longer-term security.

Remortgaging activity plummeted after the financial crisis, decreasing 55% in value and 52% in volume between 2008 and 2009.

However, since then it has rebounded significantly. Compared to 2010, when remortgaging reached its lowest point – £40.1bn in value and 319,300 by volume – activity has increased by 64% to £65.7bn and by 21% to 384,950 in 2016.

Homeowners are choosing to remortgage more frequently – on average every four years and nine months. This compares with four years and eleven months in 2015.

LMS said 89% of remortgagors were able to lower their monthly mortgage rate and one in five lowered their monthly repayments by up to £500.

When surveyed, 66% of people who remortgaged in November plan to remortgage again within the next four years in a bid to keep capitalising on the low rates available.

Knee said it is unlikely that rates will remain at their current level. “We expect lenders to start raising the rates they have on offer – a view reflected among borrowers – 32% now anticipate a rate rise in the coming year.

“The full impact of the EU referendum is still waiting to be felt in most areas of the economy, including the mortgage market. We expect confidence to fluctuate in March if Article 50 is declared, as expected. Rising inflation will apply added pressure to household budgets, so any way to reduce outgoings, such as remortgaging, will be welcome relief to many families who start to feel the squeeze.”