First-time buyers are also getting older and come predominantly from the highest earning areas of society.

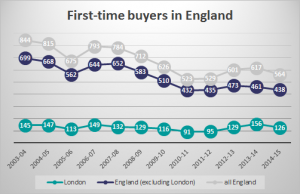

The English Housing Survey from the Department of Communities and Local Government (DCLG), revealed that overall first-time buyer numbers fell by a third across England between 2003-04 and 2014-15.

Stuck in a rut

In 2003-04 there were 145,000 first-time buyers in London and a total of 699,000 in the rest of England – these figures dropped to their lowest levels in 2010-11 (down 37% and 38%).

In 2003-04 there were 145,000 first-time buyers in London and a total of 699,000 in the rest of England – these figures dropped to their lowest levels in 2010-11 (down 37% and 38%).

Since then, London has by-and-large recovered to around its previous level (126,000 buyers) while the rest of the country has remained entrenched 37% lower at 438,000.

The study counts first-time buyers who had bought for the first time in the last three years. (Click on graphs for a larger image)

Aging buyers

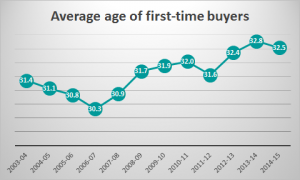

First-time buyers are getting older too.

First-time buyers are getting older too.

In 2014-15, the average age of first time buyers was 33, up from 31 in 2004 – 05. Almost two thirds (61%) of first time buyers were aged between 25 and 34 years.

Younger people aged 25-34 are also more likely to rent privately than to be buying with a mortgage.

Over the last 10 years there has been a significant increase in the proportion of younger households in the private rented sector. A quarter (24%) of those aged 25-34 lived in the private rented sector in 2004-05, but this almost doubled to 46% in 2014-15.

During the same period, the proportion of 25-34 year olds buying with a mortgage decreased from 54% to 34%.

High earners

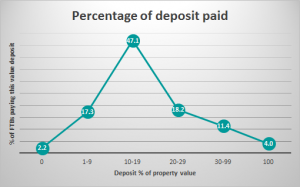

With an average deposit of £42,505 (£25,000 median), the report noted it was not surprising that most first-time buyers were among the country’s highest earners – 72% were in the fourth and fifth income quintiles.

With an average deposit of £42,505 (£25,000 median), the report noted it was not surprising that most first-time buyers were among the country’s highest earners – 72% were in the fourth and fifth income quintiles.

The data also highlighted the importance of the return of high loan-to-value (LTV) mortgages in the first-time buyer market.

Two thirds (67%) of first time buyers paid a deposit of less than 20%; and while the majority (83%) of first time buyers used savings, 27% had help from family or friends while 10% used an inheritance. Many first-time buyers used a combination of sources.

A very small number (20,000 or 4%) bought their first home outright.

Renters’ aspirations

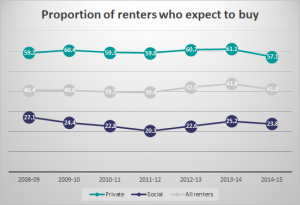

Those aiming to buy their first property are less positive for those in the private rented sector.

Those aiming to buy their first property are less positive for those in the private rented sector.

In 2014-15 the proportion of private renters who expected to buy a property at some point in the future fell to 57%, the lowest level since 2008-09.

However, although this was low, the DCLG noted that it was not significantly different from the proportion of private renters who expected to buy in 2008-09 (59%).