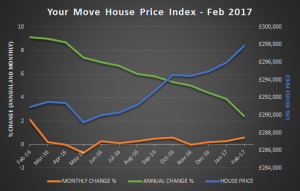

In the year to February, prices rose just 2.4% with the average house price in England and Wales costing £297,832.

Estimated transactions in England and Wales in February were also down 0.4% on January at 62,000 but the year-to-date remained higher than in 2015 and 2013. (Click for larger graph image)

Estimated transactions in England and Wales in February were also down 0.4% on January at 62,000 but the year-to-date remained higher than in 2015 and 2013. (Click for larger graph image)

However, in February prices grew at their fastest monthly rate (0.6%) since October.

The estate agent noted that a strong start to the year for house prices was not yet reflected in annual figures, which suffered when compared to the previous year due to price spikes ahead of the last April’s Stamp Duty hike.

“When these drop out of the calculation in a couple of months, though, we hope to see the more positive trend,” it added.

Around the country, Merseyside and Birmingham experienced their peak prices – up 5% and 6.2% respectively – while the east of England saw the highest prices rises, up 5.9% over the year.

The North East was the only region that saw prices fall over the year (down 0.2%) although they held steady in February.

The housing market also remains unstable.

Despite annual price growth of more than 4% in the North West and West Midlands, both regions saw price falls from January to February.

Your Move and Reeds Rains managing director Oliver Blake said it was an encouraging start to 2017.

“The good news is that the number of first-time buyers grew last year and house building was up – although home ownership is now at its lowest level in over three decades.”