The year-on-year rate of 2.3% was at its lowest since April 2013 and continues a near year-long slowdown in increases, according to the Rightmove House Prices Index.

The average asking price across the country was £306,231 in February, up from £300,245 in January.

Rightmove suggested this was a sign that vendors were becoming more realistic and that the housing market was showing an inevitable slowing given its previous rapid pace.

It also noted that the peak in the buy-to-let sector experienced last year could be having a residual effect on the market.

Green shoots

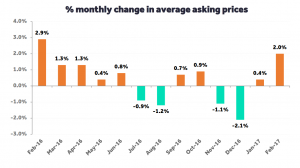

February saw the largest month-on-month increase (2.0%) since a year ago, perhaps indicating that sellers may be becoming more optimistic.

February saw the largest month-on-month increase (2.0%) since a year ago, perhaps indicating that sellers may be becoming more optimistic.

However, this was also the lowest February increase since 2009, which typically averaged 5% over the last seven years.

Rightmove director and housing market analyst Miles Shipside (pictured) noted that while the general rate of inflation was increasing, the pace of property inflation was slowing.

“Perhaps we’re approaching the territory where many buyers are unable or unwilling to pay what sellers are asking, given the negative combination of rises in the cost of living, tighter lending criteria, and a dose of Brexit uncertainty,” he said.

“The housing market has had a long sprint since April 2013 when the annual rate was last below this level, so it’s not surprising that upwards price pressure is running on tired legs with average prices today being 23% or nearly £60,000 higher than they were then.

“The housing market has had a long sprint since April 2013 when the annual rate was last below this level, so it’s not surprising that upwards price pressure is running on tired legs with average prices today being 23% or nearly £60,000 higher than they were then.

“This surge in the cost of home ownership highlights some of the issues referred to in the government’s recent White Paper on fixing the broken housing market,” he added.