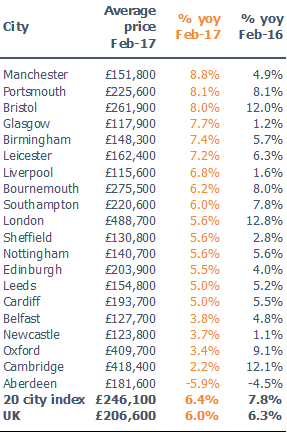

According to the latest Hometrack UK Cities House Price Index, inflation is running at 6.4% across the country – compared to 7.8% in 2016.

Affordability pressures continue to hit high value cities in southern England while supply and demand dynamics are not strong enough in many regional cities outside the south to support double digit rates of house price growth.

London’s slowdown is still notable. Its 5.6% rate of annual increase, the lowest level since 2013, has seen the capital fall to tenth place in the list of the fastest growing cities. Slower growth in London is also acting as a drag on headline growth.

By contrast, Manchester is registering the highest rate of growth at 8.8%.

Hometrack said turnover has been flat or falling in the highest value, least affordable cities like London and Bristol. This is a result of weaker investor demand, the impact of the Brexit vote on buyer sentiment and stretched affordability levels.

Sales levels in these cities peaked in 2014/2015 and in London overall sales volumes are now down 8% since 2015. This would be greater without the surge in investors buying before Stamp Duty changes were made in April 2016.

Falling oil prices have hit Aberdeen – it has suffered a 5.9% annual drop in prices as a result and is the only city to register falls.

Meanwhile Manchester and other regional cities such as Liverpool, Leicester and Birmingham have recorded significant surges in transaction volumes of between 30%-40%+ over the past three years as buyers return to the market supported by an improving jobs market and record low mortgage rates.

Richard Donnell (pictured), insight director at Hometrack, said levels of housing turnover across UK cities are expected to remain broadly flat over 2017.

“There is some further upside for sales volume in regional cities but much depends upon how would-be buyers respond to external factors, not least the impact of lower real wage growth, the potential for higher mortgage rates and whether demand will be impacted by the triggering of Article 50 at the end of the month,” he said.

Donnell added: “Buyers are fully aware of the government’s plans and timescales for Brexit but there remains huge uncertainty over what this means for the economy over the next two to three years and beyond. In cities where affordability remains attractive we expect demand to hold up in the short term albeit with slower growth in sales volumes. Overall we continue to expect the rate of house price growth to moderate over the rest of 2017.”

Table 1: City level summary, February 2017