The Nationwide House Price Index showed prices increased by 1.1% over the first quarter of the year compared to the final three months of 2016, with an annual increase of 4.1%.

Experts have suggested that slowing price rises of a flattening market could be a positive development to allow potential homeowners to catch-up.

Nationwide chief economist Robert Gardner (pictured) said there was a patchwork of pricing views across the UK in Q1, although the north-south divide appears to be narrowing.

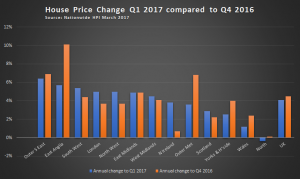

“Six regions saw the pace of house price growth accelerate, six saw a deceleration and one (East Midlands) recorded the same rate as the previous quarter,” he said.

Second smallest gap on record

The outer South East was the strongest performing region in Q1 2017, with average prices up 6.4% year-on-year. (Click graph to expand.)

The outer South East was the strongest performing region in Q1 2017, with average prices up 6.4% year-on-year. (Click graph to expand.)

The North continued to be the weakest performing region, with a slight decline in prices compared with Q1 2016.

Northern Ireland saw a pick-up in the rate of growth compared to the last quarter, with a 3.8% annual increase.

Price growth in Scotland remained fairly steady at 2.9%, while Wales saw a slight softening in annual house price growth to 1.2%.

“Interestingly, the spread in the annual rate of change between the weakest and strongest performing regions was at its narrowest since 1978 at 6.8 percentage points – the second smallest gap on record,” Gardner continued.

“The south of England continued to see slightly stronger price growth than the north of England, but there was a further narrowing in the differential.”

Cooling market

Listed broker Mortgage Advice Bureau (MAB) suggested the results indicated demand and limited supply was dictating price increases around the country and noted that the market could be levelling off.

“In context, values cooling by less than 0.5% month on month and annual growth remaining steady – particularly compared to March 2016 which was exceptionally busy, as has been noted by other industry sources previously – could perhaps suggest that the market is flattening,” said MAB head of lending Brian Murphy.

“In itself, this wouldn’t perhaps be a negative trend, as a slowing down of prices coupled with the ongoing near record low mortgage rates available may provide a welcome opportunity for those who want to get onto or move up the property ladder to take advantage of the current climate.

“Given that the Nationwide report includes data from Department of Communities and Local Government showing that home ownership levels are at their lowest since the mid-eighties, then any market conditions which may assist more people to buy their own property could be seen as a positive development, rather than a cause for concern,” he added.

Don’t panic

This was echoed by Legal and General Mortgage Club director Jeremy Duncombe who argued the slight dip was no cause for panic.

“Indeed, instead of focusing on monthly fluctuations, we should concentrate on the growing gap between supply and demand,” said

“A lack of affordable homes, Stamp Duty and planning challenges are the big three factors that are hindering our housing market. If we are ever going to see a more normal housing market, we need to see more affordable homes being built across all tenures, particularly in the shared ownership market.

“The housing market would benefit from a relaxation on Stamp Duty, which is stifling transaction flow and a review of the current archaic approach to building on green belt land,” he added.