While progress had been made in many areas of lender technology, brokers reported it was still taking too long to input client applications – three quarters said it was taking up to an hour, and the remainder said it was taking between one and two hours.

The technology firm said this indicated poor usability and that intermediaries were questioning some of the data being requested by lenders as unnecessary, duplicated and irrelevant.

IRESS principal mortgage consultant Henry Woodcock (pictured) told Mortgage Solutions that some systems repeated questions which was simply a design flaw.

“Some systems do ask the same questions at different stages when the adviser has already keyed-in the same data – the two parts are two different systems not passing the data over,” he said.

“Better systems will proactively ask about lending into retirement where relevant but others are very dumb and need to make the customer experience better.

“Some lenders still capture data that’s going to be used to cross sell insurance. If I’m a broker there for a mortgage why do I care about insurance?” he added.

Broker and lender action

The research also highlighted the continued reliance on phone calls when discussing cases – with only 40% of brokers saying they were able to complete an average case in three calls or fewer.

The research also highlighted the continued reliance on phone calls when discussing cases – with only 40% of brokers saying they were able to complete an average case in three calls or fewer.

Woodcock suggested this required a change in approach from lenders and intermediaries.

“If the systems were good enough they wouldn’t have to make all those calls” he said.

“The technology is not really fully mature for brokers to be confident in it. Also, brokers have been around for a long time and some lenders who have spent a lot of money are still getting a lot of calls.

“They need to change the way they engage brokers and have to induce to brokers to use it to bridge the difference,” he added

Good alignment

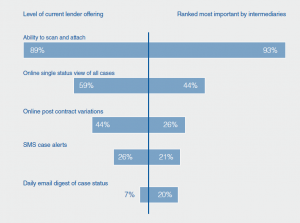

However, lenders are generally aligning themselves well with broker priorities:

- 89% of lenders now offer scan and attach at point of sale, up from 75% last year,

- 59% of lenders provide an online single status view of all cases, up from 44% in 2016,

- 85% of lenders provide real-time case tracking, compared to 75% last year,

- 70% of lenders provide online dashboard summaries, up from 38% in 2016.

But Woodcock added that they needed to focus more on the overall experience and usability.

“Clever lenders see the whole experience – they join the whole process up. They look at whole journey not just getting in offer out in one day,” he said.

“Yes lenders are improving – some have improved functionality in a number of areas including decision in principle.

“But many brokers still find systems difficult to use,” he added.