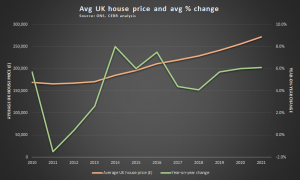

According to analysis by the Centre for Economics and Business Research (CEBR), the average house price in five years’ time will be £272,000, up from £211,000 in 2016.

CEBR noted that low transaction numbers over the coming years would keep price inflation subdued at 4.1% in 2018 before picking up again from 2019 onwards. (Click graph to enlarge.)

CEBR noted that low transaction numbers over the coming years would keep price inflation subdued at 4.1% in 2018 before picking up again from 2019 onwards. (Click graph to enlarge.)

It added that the impact of the Brexit vote was starting to be felt with higher inflation eroding real income growth.

“A slowdown in consumer spending and a potential blow to consumer confidence present downside risks for the UK housing market,” the research said.

Cebr also cited other factors including government regulation, the rise in Stamp Duty on second homes and changes in buy-to-let mortgage tax relief that had taken steam out of the market.

Lower borrowing costs

However, it recognised that the Bank of England’s action on lowering the base rate had lowered borrowing costs.

“After a turbulent 2016, first data for Q1 2017 suggest that the property market is moving along at a steady if unspectacular pace,” said CEBR economist Kay Daniel Neufeld.

“Mortgage approval numbers, a leading indicator for property transactions, have recovered from their mid-2016 low and remain on a stable level of close to but just under 70,000 per month. While this is a low figure compared to the historical average, it is near the post-crisis high of 74,000 seen in early 2014.

“Looking at the market fundamentals, the shortage of suitable housing continues to exert pressure on property prices – according to the government’s housing white paper, more than 40% of local planning authorities do not know how to meet local housing demand over the next ten years,” Neufeld added.

Fewer BTL landlords

Cebr also expects that the shift in the tax regime will significantly reduce the number of private buy-to-let landlords in the market.

Legal and General Mortgage Club director Jeremy Duncombe said prices starting to rise closer to inflation should be good news.

“The underlying fact remains that our housing market is hindered by an imbalance between supply and demand,” he said.

“The fact that house prices are continuing to increase during uncertain economic times reflects the unfaltering confidence in brick and mortar and the nation’s desire to own their own home.

“A continued increase in house prices also highlights the perfect opportunity for borrowers to consider remortgaging,” Duncombe added.