The Financial Conduct Authority (FCA) has also resumed its investigation into the extent of HBOS’ knowledge of senior bank employees’ corrupt behaviour which led to the ruin of small businesses to fund their lavish lifestyles.

The investigation into misconduct within the Reading-based impaired assets team of HBOS was put on hold in early 2013, when the FCA alerted Thames Valley Police of their findings and were asked to freeze their activity pending the outcome of police inquiry.

Bank review

Lloyds Bank said that following the conclusion of the criminal trial, it would provide fair, swift and appropriate compensation for the victims.

Professor Russel Griggs was appointed as the Independent Customer Reviewer in consultation with the Financial Conduct Authority (FCA) to review customer detriment.

The bank said that although the customer review was in its initial stages, to provide additional help to those impacted customers, it would:

- Provide interim payments on a case-by-case basis to assist victims in financial difficulty with day-to-day living costs;

- Cover reasonable fees for professional advice whilst in the Professor Griggs’ review to enable customers to access appropriate legal and financial advice;

- Write off customers’ remaining relevant business and personal debts currently owed to LBG, where they were victims of the criminal conduct, and not pursue them for any repayment.

It added that it had already suffered losses or provided for at least £250m of credit losses in relation to those impacted cases at HBOS Reading in previous financial periods and that it anticipated that compensation for economic losses, distress and inconvenience would be in the region of £100m.

Criminal convictions

Operation Hornet, the police investigation, resulted in the conviction of five men and one woman with combined prison sentences of 47 years and nine months.

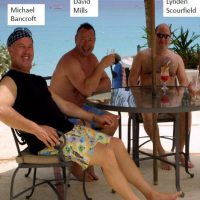

Former HBOS senior banker Lynden Scourfield (pictured), 54, of Whitton Avenue West, Greenford, Middlesex, pleaded guilty on 12 August 2016 to charges of conspiracy to corrupt, fraudulent trading and money laundering. He was sentenced to 11 years in prison on 2 February this year.

Scourfield was bribed to refer businesses to a consultancy firm headed up by David Mills, 60, of Moreton-in-Marsh, Gloucestershire which claimed to help struggling firms out of of liquidation. In return, Scourfield received hundreds of thousands of pounds, holidays to Thailand and Barbados and parties involving prostitutes.

Financial turmoil

The business customers, already in financial turmoil, were advanced large sums of cash which they could not afford to repay, while Mills and his associates received significant fees for their services.

Mills was jailed for a total of 15 years.

Mills’ wife, Alison, 51, received three and a half years, while business associates Michael Bancroft, 73, and John Cartwright, 72, got 10 years and three and half years, respectively. Mark Dobson who also worked at HBOS and received kickbacks from Mills was imprisoned for four and a half years.

A statement from the FCA read: “The FCA’s investigation is focusing on the extent and nature of the knowledge of these matters within HBOS and its communications with the Financial Services Authority after the initial discovery of the misconduct.”