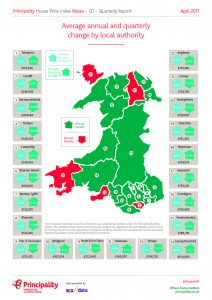

The index, which is based on Land Registry data, found the average house price in Wales reached a new high of £174,319 during the first quarter of 2017.

The inaugural report noted that house prices in Wales have been slowly climbing over the last four years and at the end of Q1 2017 the average was 2.5% above the October 2007 peak of £170,142.

Although the annual rate of growth in the last quarter was the lowest seen since September 2013, this was distorted by the exceptional first three months of 2016 ahead of the introduction of the 3% surcharge in Stamp Duty on second homes and buy-to-let properties.

Cooling market

Principality Building Society interim finance director Tom Denman said: “While the average house price in Wales has steadily climbed to reach a new high, there are signs that the market is cooling slightly.

Principality Building Society interim finance director Tom Denman said: “While the average house price in Wales has steadily climbed to reach a new high, there are signs that the market is cooling slightly.

“While higher employment, consumer confidence and low interest rates have helped to keep the market demand steady, a rise in the cost of living could result in house prices growing at a more modest rate during the rest of the year.”

The report suggested that the quarterly rate of a 0.7% increase in house prices provided a more informed picture of the current housing market, as this was not influenced by the increases in Stamp Duty.

This quarterly rate reflected a slowing of the growth in house prices over the winter months from January to March 2017, it added. (Click to expand graph.)