It cut rates across its range of five year fixed products from 60% loan to value (LTV) all the way up to 90% LTV.

The move drove significant interest from brokers while raising eyebrows and furrowing brows at many lenders.

What made the biggest noise was the scale of the rate cuts and how far below the previous lowest rates it placed Atom Bank.

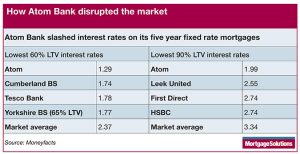

As the table shows, (click to enlarge) Atom Bank’s five-year fixed mortgage range is now about 0.5 percentage points cheaper than the next lowest lenders at either end of its LTV scale.

As the table shows, (click to enlarge) Atom Bank’s five-year fixed mortgage range is now about 0.5 percentage points cheaper than the next lowest lenders at either end of its LTV scale.

And the lender, which launched its mortgage proposition in December, is more than one percentage point lower than the average in these two comparisons as well.

Tactical manoeuver

Atom Bank director of retail mortgages Maria Harris (pictured) told Mortgage Solutions the move was a short-term tactical one intended to raise brand awareness with brokers and customers on the back of its savings initiative.

“We had table topping savings rates and took a good number of customers on that and now we’ve got that savings money sitting, waiting to be lent out,” she said.

“Because we’re a digital bank and the proposition is very different to what advisers have done before, we wanted to do something just a little bit special.

“It’s a short-term deal so, it’s not going to be there for long,” she added.

Although a firm time limit has not been set on the offer, Harris said it was a “really short window”. But fitting with its digital origins, the bank is monitoring applications in real time and will make a decision on its next pricing change accordingly.

Mainstream criteria

Atom has not changed its underwriting for this product, using the same criteria as when it launched in December.

“The aim was to be disruptive, which we’ve achieved,” continued Harris.

“We wouldn’t normally use such a pricing strategy, we’re doing something that’s right for us right at this moment. But even before we put those rates out we were sourcing at the top end of the pack and that’s where we intend to be.

“This is all about using digital technology and the low-cost model to give back savings to the customer in terms of the best products that we possibly can and that’s definitely the long term strategy for the bank and what we’re all about,” she added.

Targeting market share

Industry whispers questioned whether the rate cut was designed to grab a significant target market share in a short period of time as Atom aims to join the big mainstream high street lenders.

However Harris denied this, saying the bank “absolutely” wanted to be a top mainstream lender, but that it was a longer journey.

“We’ve got limited distribution today, we need to grow our balance sheet, we need to grow our capital positions first,” she said.

“We don’t have targets, we don’t target our teams, we don’t pay cash bonuses, we don’t have any of that targeting model. We have a business plan to manage to, but that’s not a targeted one.”

Accidental pricing

Broker interest has been unsurprisingly strong, with several asking if Atom had made a mistake with its rates, while customers getting in contact have all been referred to intermediaries.

Atom only has a limited intermediary distribution network at present and Harris acknowledged this will disappoint some brokers.

“It’s been challenging for the people who aren’t on our panel yet but that’s something we have to manage,” she said.

“We are a new bank and just don’t have the scale or capital to do whole of market yet and we’re going to be a little way from that. That’s something to be aware of, we knew that would happen – if you do something new and exciting people want to be a part of it – but we’re not big enough to do that with everyone yet,” she concluded.

The bank still has moves to make, including guarantor and buy-to-let products which are already planned.

Atom Bank launched mortgages to intermediaries in December, as exclusively reported by Mortgage Solutions.