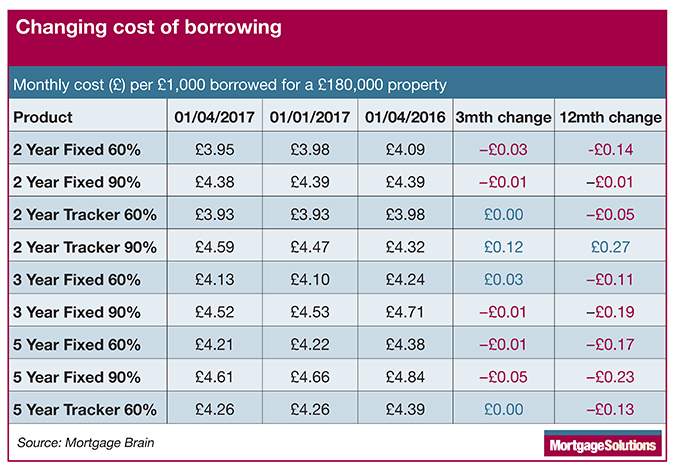

Research by Mortgage Brain found that typical tracker mortgages were already starting to rise while fixed-term deals, particularly longer ones at higher loan to values (LTV) were still becoming cheaper.

Despite the short-term analysis showing little movement, year-on-year reductions in the cost of mainstream mortgages continued. (See table for full details.)

The analysis was conducted on 1 April so does not include Atom Bank’s market beating rate cuts that were announced more recently and which the lender pulled from the shelves yesterday.

Mortgage Brain conducted the analysis by calculating the monthly borrowing cost per £1,000 on a £180,000 property.

The lowest rate 90% LTV five-year fixed deal saw the biggest decrease over the last 12 months, now costing 23p per month per £1,000 borrowed less than it did this time last year – a 5% fall.

Similarly, its three-year fixed counterpart cost 19p less a month than it did in April 2016 (down 4%).

However, a two-year 90% LTV tracker is now 27p more expensive than this time last year – a rise of 6.25%.

Mortgage Brain CEO Mark Lofthouse, (pictured) said: “Our latest product data analysis shows that there’s little to get excited about in terms of rate and cost movement over the past three months.

“Following the long period of record lows, however, our short-term analysis can be seen as another sign that we are moving towards a period of cost and rate stability, or even potential rises.”