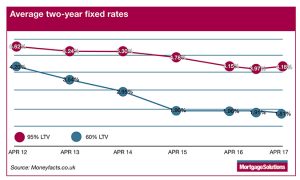

According to Moneyfacts the gap between the biggest and smallest loan-to-value (LTV) deals has stretched wider during this period.

For those with the biggest deposits taking a 60% LTV product, their average interest rate has fallen to 1.81%.

For those with the smallest deposits seeking a 95% LT deal, their average interest rate has risen slightly to 4.18%.

For those with the smallest deposits seeking a 95% LT deal, their average interest rate has risen slightly to 4.18%.

The divergence between the two ends of the scale has grown by 0.31 percentage points in just six months, and by almost a full 1% over five years. (Click graph to expand.)

Last week Mortgage Brain released interest rate analysis which echoed these findings. It also found that longer term fixed-rate deals were continuing to get cheaper.

Intense competition

Moneyfacts spokeswoman Charlotte Nelson noted there would always be a difference between the two sectors due to the extra risk involved in lending to a borrower with just a 5% deposit compared to those with a much larger deposit.

“With improvements seen throughout the mortgage market of late, particularly for those with a 5% deposit, many would assume that the LTV-gap would have narrowed or even been bridged,” she said.

“However, it is disappointing to find that the reverse is true, with the gap bigger now than it was five years ago. Deals on the market today can seem worlds apart, particularly when you look at the lowest available on the market. For example, the lowest two-year fixed rate at 60% LTV is 0.99%, whereas the lowest at 95% stands at 3.29% – a whopping 2.30% difference.

“The 60% LTV sector has been lenders’ main target for some time, with providers actively seeking to be the lowest ever across the market, and it is this intense competition that has seen the gap grow despite average rates for higher LTVs also falling,” she added.