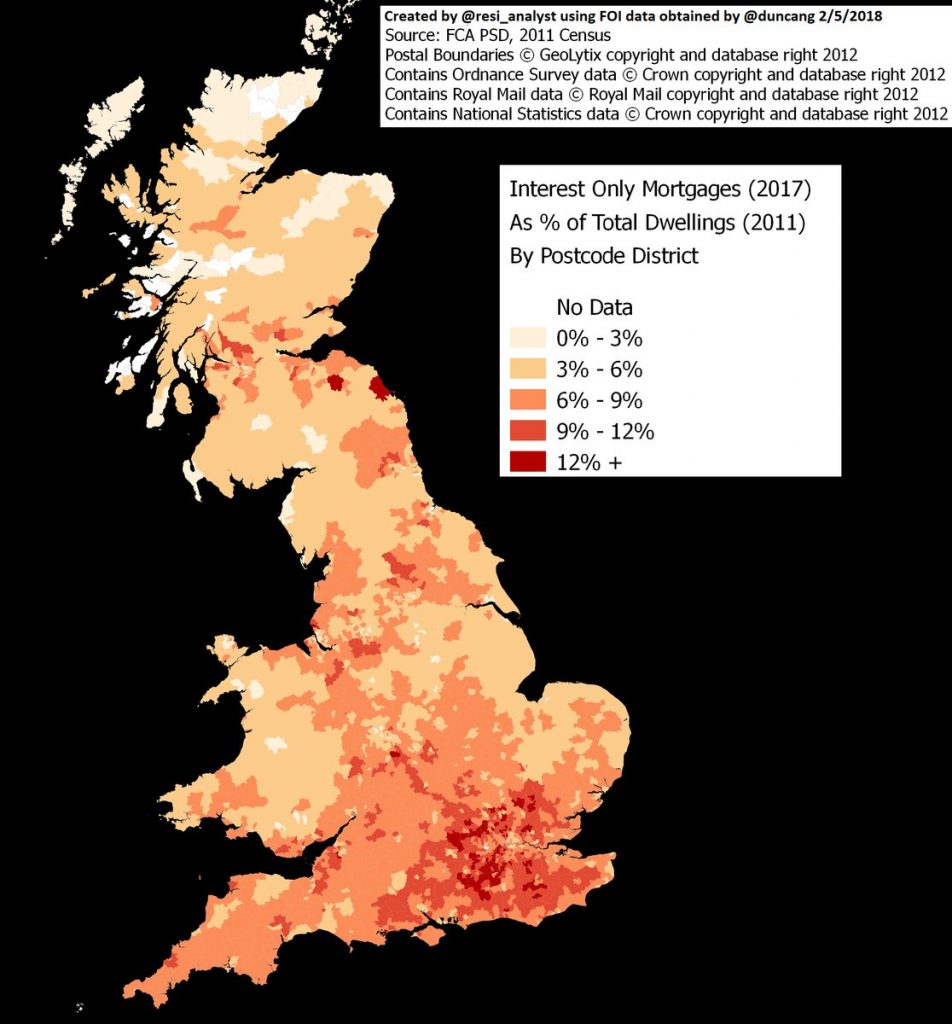

The highest proportion of residential interest-only mortgages are on homes located in the South East, a map of the data by Residential Analysts showed.

In a number of areas surrounding the capital, 12% or more of homes are on the products, which were widely available in the run-up the to the financial crisis.

In the town of Radlett in Hertfordshire it was found that around 20% of properties are on interest-only mortgages.

Some of the highest proportions of the deals are in holiday home hot spots – although the data does not include buy-to-let mortgages.

Neal Hudson of Residential Analysts, who put together the map, said: “Although interest-only is frequently viewed as a problem for more stretched households, the map shows that they are also regularly used by people living in higher priced areas or second home hotspots, perhaps as a useful tool to optimise their finances.”

After the financial crisis, lenders put heavier restrictions, such as minimum incomes or equity, on the use of interest-only mortgages.

London & Country associate director, communications David Hollingworth said: “It’s interesting to see how the level of interest-only use varies regionally and although there are exceptions there is generally greater use in the South East.

“For newer borrowers that might be expected as lenders have put an accent on interest-only of it being a higher net worth product.

“Some providers will have a minimum loan and/or income requirement on interest-only which will therefore make it a product more widely available to higher earners.

“More historical lending will not necessarily have been subject to those requirements though and could be a by-product of high prices and borrowing requirements.

“Despite the fact that price growth may also have been more significant it doesn’t remove the need for borrowers to ultimately repay the capital,” he added.