Latest results from the Finance and Leasing Association (FLA) showed a year-to date increase of 10% within the second charge market, although there was something of a summer lull.

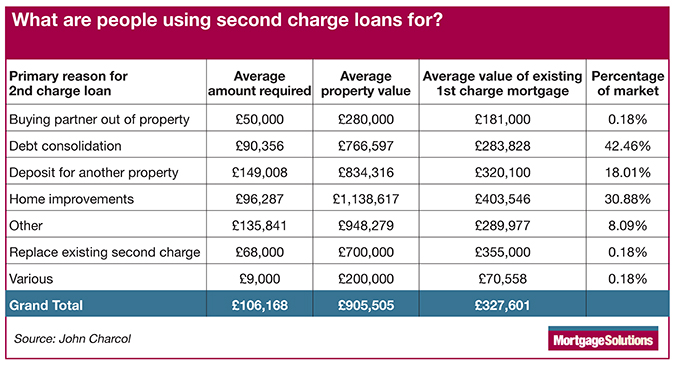

However, figures from John Charcol given exclusively to Mortgage Solutions’ sister title Your Money, reveal the key borrowing needs that second charge loans are meeting.

It shows that second charge borrowers typically take out a loan of £106,168 based on a property value of more than £900,000.

And there are three key reasons driving the market: debt consolidation, home improvements, and deposit for a second property. (Click to expand chart.)

When combined these accounted for 90% of all second charge borrowing arranged by John Charcoal from January 2016 to September 2017.

Specialist Lending Solutions canvassed opinions from second charge experts on whether further growth in demand is likely to continue or if it will be constrained by a general squeeze on incomes and increased interest rates.

Here’s what they had to say:

Tim Wheeldon, chief operating officer at Fluent for Advisers (pictured)

I have always maintained that we need to manage expectations concerning the expansion of second charge mortgages. The Mortgage Credit Directive (MCD) certainly put secured loans on advisers’ radar, but was never going to be the starting gun for massive immediate expansion.

Like the fable of the tortoise and hare, slow and steady is winning the race. We have seen steady growth in the sector this year. In August, the trend was still upwards and I expect that to continue. Second charge mortgages have a legitimate place for capital raising and our job is to educate advisers when and where secured loans are most appropriate.

Second charge mortgages will, like the rest of the lending market, respond to the laws of supply and demand, but I am confident that the growth curve will be upward as more advisers recognise where secured loans can be the appropriate choice for clients.

Graeme Wade, head of sales at Spring Finance

The second mortgage market is in a strong position and offers some incredible criteria for clients who are either unable, or advised not to, remortgage through conventional sources. The rates on offer are as competitive as they have ever been with more and more lenders looking to enter this market as they see the potential growth and importance of this sector and the customers it serves.

The potential rate rise has been discussed for months and speculation has grown during 2017, with November being the month currently predicted for an increase and it is clear high street banks are gearing up for this to happen with the increase of their fixed-rate deals.

A high percentage of customers are introduced to the second mortgage market through their mortgage advisers and it will continue to evolve and grow regardless of future base rate rises as we have access to a wealth of experience across both lender and introducer level.

Richard Tugwell, group intermediary relationship director at Together

Looking at the FLA data for August we need to recognise that volumes are up 25% when compared to August 2016, so the fact that monthly lending was flat is probably more indicative of a seasonal slow-down as brokers break for the summer.

Second charge lending has been increasing year-on-year and there is a clear demand for this type of finance.

Given that interest rates are at an historic low, even if there is an increase, it’s likely that we’ll still see demand for second charges as an alternative to remortgaging, for those that don’t want to lose their current deal or are finding it difficult to borrow more from their existing lender.

There is flexibility with a second charge so they can choose a term that suits them, and possibly also avoid paying early repayment charges on their first charge mortgage.

Since Brexit, there’s been a market trend for customers to improve their current property rather than move, with home improvements being one of the main reasons for customer taking a second charge, and that looks likely to continue for the time being, which will continue to feed demand.