The MPC voted 7-2 and not to add to the current bond buying programme of £645bn, though two members supported an extra £100bn of purchases.

The committee also suggested there could be more stimulus in June and there was no limit to the bond-buying programme, like the US Federal Reserve and European Central Bank.

According to the Office for National Statistics (ONS), GDP contracted two per cent in the first quarter of 2020 – better than the expected decrease of 2.5 per cent, but still the largest fall since the financial crisis.

Monthly GDP decreased by 5.8 per cent in March, the largest monthly fall since 1997, however this was still above analysts’ expectations of a decrease of 7.2 per cent.

Economic impact and recovery

The committee has also constructed an “illustrative scenario” which predicts that UK growth will fall by 25 per cent in the second quarter of 2020 but will recover, which will lead GDP to crash by 14 per cent over the year.

This would be the worst economic drop since 1706. However, it was predicted that it will strongly rebound by 15 per cent in 2021.

It added that the coronavirus impact will lead to inflation to drop below one per cent and will stay low and only recover to the two per cent target in 2022.

The BoE predicted that UK unemployment is expected to increase to nine per cent in the second quarter of this year, this is higher than the 2008 financial crisis and assumed the rate to remain high at seven per cent in 2021 and recover to four per cent in 2022.

To put things into perspective, the UK’s unemployment rate was at 3.9 per cent in February.

Near-zero base rate

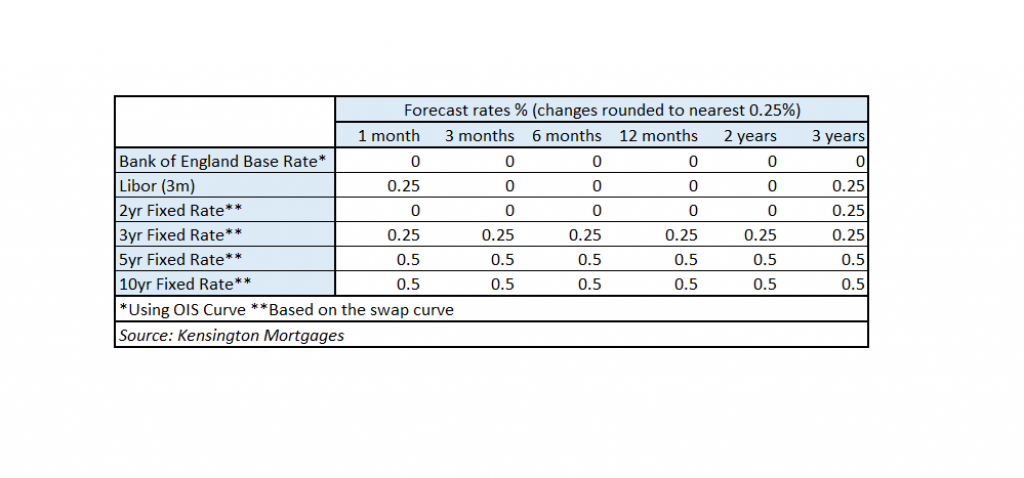

The market now expects the BoE base rate to remain at close to zero basis points (bps) for the next three years.

Forecasts expect the three-month London Inter-Bank Offered Rate (LIBOR) and two-year swap rate to drop to 0bps for the next two years and increase to 25bps in the third year, while the forecast for three-year swap rate remains at 25bps.

The forecast for the five-year and 10-year swap rates remain at 50bps.