The Covid-19 situation has led to dramatic changes to product ranges by the nation’s lenders, including limiting criteria, reducing maximum loan-to-values (LTV) and some lenders pausing all activity.

But nearly two months on from the introduction of the lockdown, there are positive signs that things are starting to improve.

Product availability

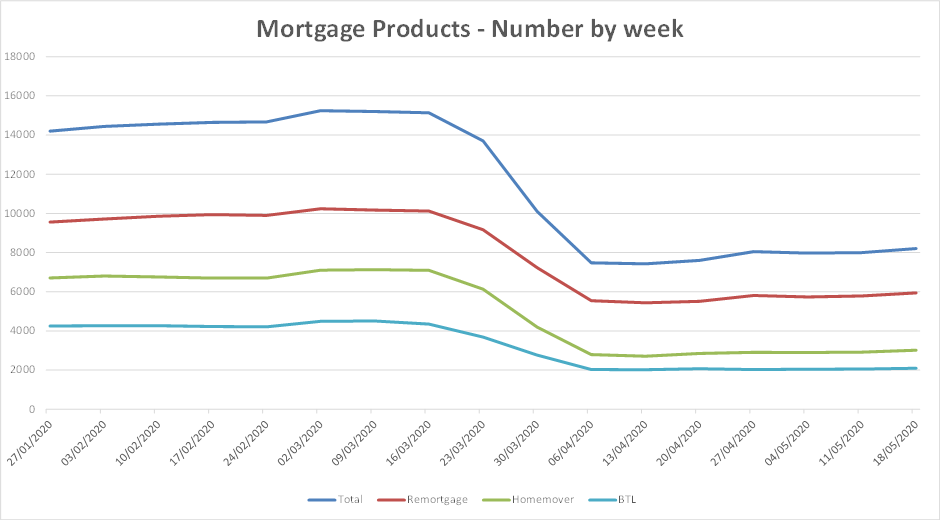

Mortgage Brain’s data on product numbers shows that the number of products was at its lowest point in the week of 13 April and last week it was 11 per cent above this low at 8,203 deals.

However, last week’s number is 44 per cent down on what the market looked like just a couple of months ago.

There is cause for optimism in the fact that the number of products available has seen noticeable growth over the last five weeks.

While many of those specialist lenders who put up the shutters when the crisis really took hold are yet to return, some have started to dip their toes back in the water and resumed limited lending and, the lenders who remained active are increasing their LTVs and reversing the criteria changes made to their product ranges.

ESIS rising

It’s a similar story with the number of ESIS mortgage illustrations being produced through Mortgage Brain.

There is no denying the fact that there has been a sharp drop off, with the number of ESIS produced last week 37 per cent down on the nine-week average to 16 March.

Yet the number of ESIS has increased for three consecutive weeks, to the point that they are now 18 per cent up on the lowest point seen during the crisis.

This has been boosted by lenders increasing the number of higher LTV products available and we are just starting to see the impact of the purchase market starting to open up.

We can see that already in the breakdown of business along LTV lines.

Lending above 80 per cent LTV historically accounted for 36 per cent of business but dropped to a low point of 13 per cent in the week of 13 April. However, there has been a recovery to 22 per cent of all lending and this trend is likely to continue.

Reopening the market

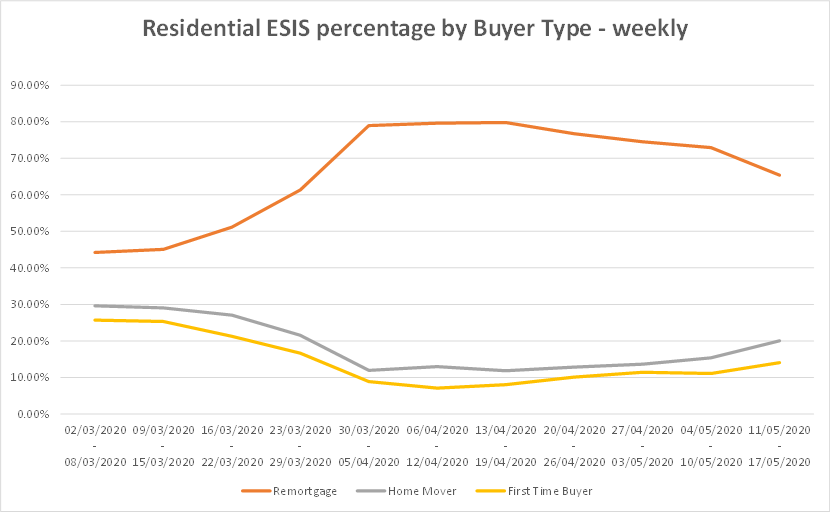

The green light to reopen the housing market is also beginning to have an impact on the breakdown of the types of mortgage being applied for.

Understandably remortgaging has dominated of late, accounting for up to 80 per cent of residential lending at its peak, but last week showed a marked reduction and it now stands at 65 per cent as purchase activity starts to return.

This is echoed in buy to let, where remortgaging has been even more prevalent, reaching 90 per cent at its peak, but here too we are starting to see the numbers borrowing to purchase on the rise.

With valuations and moving activity restarting, and estate agents opening their doors once more, these improvements in product availability and volume are likely to continue as first-time buyers and home movers who have been forced to sit on their hands can resume their property searches once more.

We don’t know precisely what lies ahead, nor what the new abnormal will really look like, but the signs are we have passed the bottom and the industry can look forward with some cautious optimism.