The Bank’s agents’ summary of business conditions for December revealed that larger companies have seen further improvement in credit conditions, but those in sectors related to property still face difficulties in securing external finance.

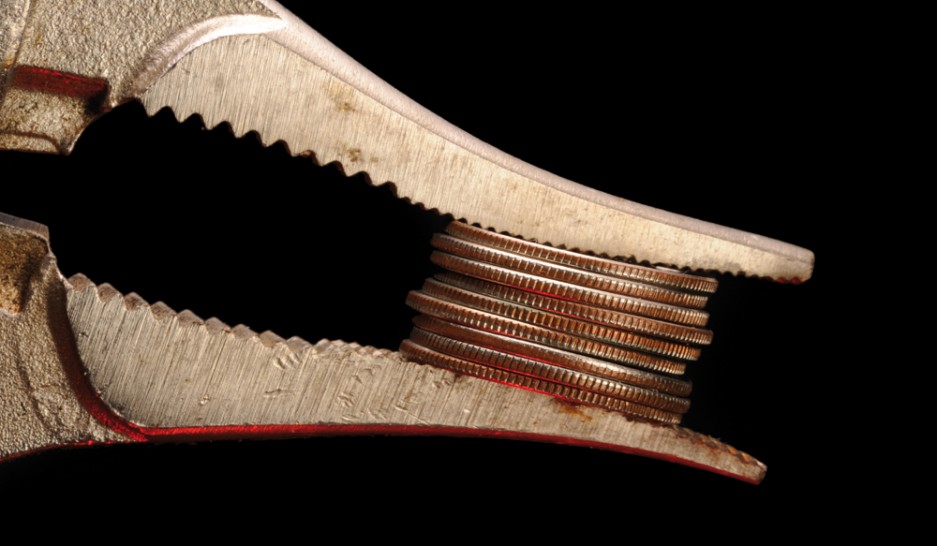

Small businesses have also continued to report that overdrafts are being withdrawn by lenders, which, in some instances, are moving away from offering overdrafts to favouring financing that poses less of a risk to their balance sheet, such as invoice discounting. The switch to this has proved much harder for small firms.

There have also been reports of long delays in lenders making decisions on loans.

In addition, smaller firms have found the application process prohibitively costly in terms of time and resource or have been discouraged by what they felt were overly stringent collateral requirements.

The report also revealed that agents believe credit scoring has limited the scope for local bank managers to act with discretion when agreeing loans, contributing to small firms’ problems in securing finance.

In addition, agents have reported the continuing slowdown of the housing market, with sales of new and existing homes falling back. Demand has been increasingly affected by wavering confidence in the future of the economy and the resulting effect on incomes.

The market has also been affected by borrowers continuing difficulties in accessing mortgages, particularly first-time buyers.

Nevertheless, declining owner-occupier demand has boosted the rental market, supporting rents and increasing investors’ interest in buy-to-let property.