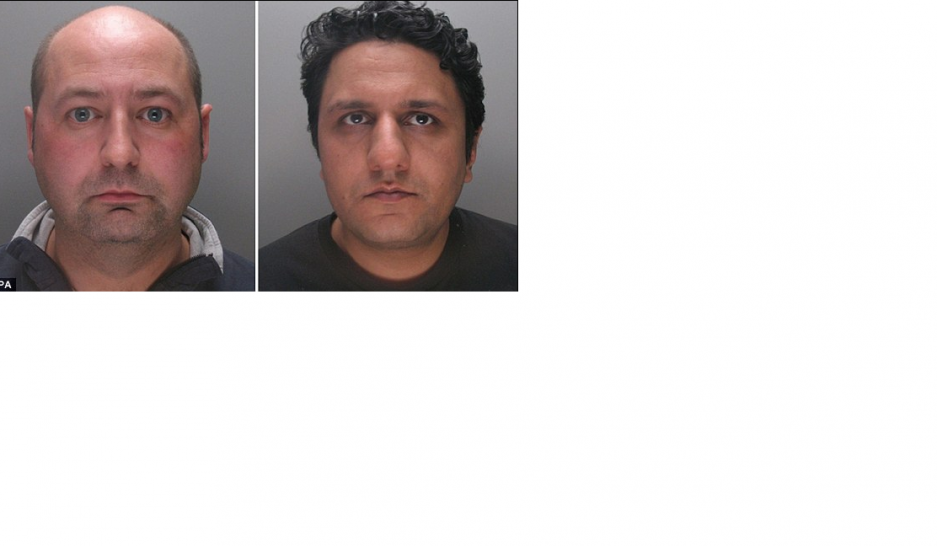

The fraud, featured on the BBC’s You’ve Been Scammed programme which ran this morning, began at the start of 2010 when bridging loan firm Masthaven was contacted about a potential £1.5m loan by mortgage adviser Jonathan Flynn (pictured left).

The broker said that he had two clients from the Middle East who owned a £5m property in Bayswater, London. Flynn said the pair of sheikhs were seeking a £1.5m loan on the property and then provided fake passports and proof of ownership to the lender.

The pair of ‘investors’ were Ahmed Ali, 47, and Shakil Ahmed (pictured right), 36, and the house was actually owned by a family from the Middle East.

The family was not living in the property at the time and had put the house up for sale. The scammers had used the Land Registry to acquire the deeds to the property to find their details.

Masthaven, unaware of the scam, sent a surveyor to the property to confirm its value. The fraudsters were able to gain access to the home by arranging a viewing with the estate agent and pretending that they were representatives of an Arabian princess who required a detailed viewing to see if her furniture would fit into the property.

However the scam soon began to unravel because Masthaven policy dictates that a face-to-face meeting must be held with all clients who wish to take a loan of over £1m. When the lender contacted the borrowers, they quickly changed the loan required to £925,000.

This caught the attention of Andrew Bloom, managing director at Masthaven. He told the programme that such big alterations made him doubtful about the case.

“When we asked then why they needed £1.5m in such a rush they were very flakey with their answers,” he told the programme.

“We contacted them and a day later the loan dropped to £925,000 and that made us suspicious.”

Bloom contacted the City of London police who began to track the case and he decided to recheck the original documents provided. He looked to verify a utility bill by contacting the energy company who were said to have provided it, they said it did not match the address they had on file.

The police became confident that the case represented a fraud, but were unable to track down the criminals as every address provided was false.

But the criminals were caught when a sting operation was launched. This saw a meeting take place with Masthaven and the fake sheikhs to catch the crooks in the act.

Ali and Ahmed were arrested at the scene and later sentenced to 30 months in prison. Mobile phones seized from the pair proved that broker Flynn was the mastermind behind the scheme and he was sentenced to four years and six months behind bars.

Bloom said he was pleased that the criminals were handed lengthy sentences.

“I was delighted that people were given a significant amount of time behind bars. Mortgage fraud is not a victimless crime. It increases the payments of me and every other consumer out there.”

The police later discovered that the passports belonged to a child that had passed away and had been altered to include a different photograph, name and address. A fourth man, Shane Martin, was also implicated in the crime but remains on the run.