The central bank surprised markets by opting not to slow the pace of its $85bn a month asset purchase programme at its September meeting, pointing to recent bond and mortgage rate rises that could “slow the pace” of the economic recovery.

The majority of investors now see the Fed’s December policy meeting as a likely start date for tapering, but others suggest an end to QE is now firmly on the backburner unless economic data improves.

“I do not understand why everyone thinks the taper will come in December now. No-one can hand on heart say that is going to happen,” Henderson head of retail fixed income John Pattullo told Mortgage Solutions sister title Investment Week.

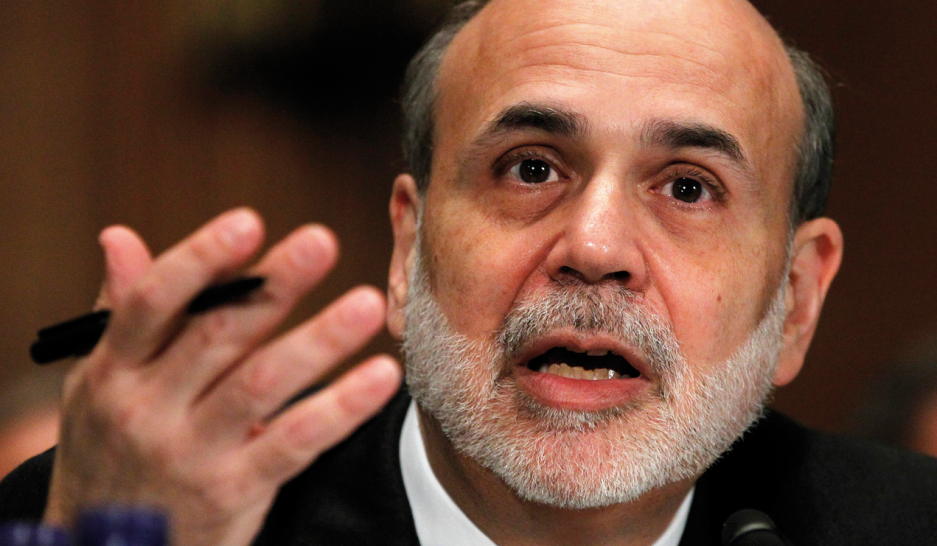

BNY Mellon strategists also suggested a 2014 move was now more likely, while BNP Paribas analysts added the Fed may wait until the arrival of Ben Bernanke’s as-yet unnamed successor as Fed chair, who will take over on 31 January 2014, before acting.

M&G investment director Anthony Doyle said last week’s move was evidence that “macro matters”.

“The ‘Fed fake’ suggests tapering is truly data dependent and not predetermined. The Fed may reduce bond purchases slower than anyone currently expects,” he said.

Pattullo agreed the decision will be based on the nature of US economic data between now and the end of the year, but said the central bank’s ‘forward guidance’ policies have become muddled.

“In focusing on the tightness of financial conditions – caused by his own comments earlier this summer – as well as expanding on the wider backdrop to the unemployment rate, Bernanke changed his emphasis last week,” he said.

“Longer-term, the credibility of the Fed, the inconsistency of its messaging and the emphasis of its policies, is of concern.”

His view was echoed by Fidelity director of asset allocation Trevor Greetham, who said the Fed chairman “seemed to be making policy on the fly”.

Last Wednesday’s surprise sparked a widespread rally in risk assets, with gold and silver also surging at the expense of the US dollar.

Benchmark bond yields fell sharply following the announcement, with 10-year treasury yields falling from 2.85% to 2.69% and 10-year gilt yields dropping from 3% to 2.86%.

But borrowing costs remain well above the levels seen prior to Bernanke’s initial tapering comments on 22 May, when US and UK yields were under 2%.