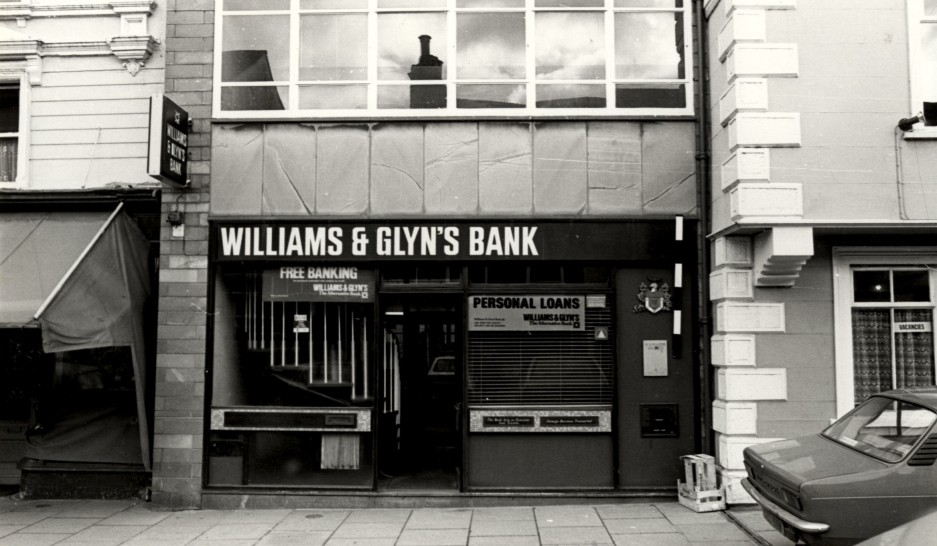

Challenger bank Williams & Glyn’s emerges from the sale of 308 RBS branches in England and Wales and six NatWest branches in Scotland.

John Maltby, ex-CEO of specialist mortgage lender Kensington Mortgages will head up the bank as CEO.

Maltby was with Kensington from 2000 to 2007 and joined Lloyds Banking Group as head of commercial banking after his shock exit from the specialist lender, which coincided with a profit warning.

CEO designate John Maltby said: “I am very excited about joining the Williams & Glyn’s team. Williams & Glyn’s will have unique advantages. It will combine the heritage of an established bank, a strong national customer franchise and an experienced and committed team with the agility, motivation and growth opportunities of a challenger. Williams & Glyn’s will commit to the highest standards of banking ethics and business conduct while providing increased customer choice in the UK Banking market.”

RBS Group chairman Sir Philip Hampton said: “Williams & Glyn’s will play an important role in the UK banking landscape and be an excellent new addition to the market, with a particular strength in small business banking – a sector that is so crucial to the UK’s economic recovery.”

As a condition of the RBS bailout the group was required to sell 314 branches with the final disposal of Williams & Glyn’s at a later date.

The bank has nearly 1.7m customers, 4,500 employees and a £19.7bn loan book, funded by £22.2bn in customer deposits.

RBSG will work with HMT and the European Commission to agree an extension to the timetable for the disposal of Williams & Glyn’s in due course.

Under the terms of the agreement with RBSG, the investors have agreed to retain their shareholdings for up to 18 months following the IPO or until RBSG has fully sold down its stake in Williams & Glyn’s, whichever is earlier.