Statistics released from 91 Councils after a Freedom of Information (FOI) request showed 38% of ex-council flats are no longer occupied by the buyer, so likely to be let out in the private rental sector.

It comes ahead of a yet-to-be timetabled government extension of the Right to Buy scheme, offering discounts of up to £100,000 for a further 800,000 housing association tenants, which could cost an estimated £4.5bn and bring the total number of eligible tenants to 1.3m.

Since Margaret Thatcher’s government enshrined Right to Buy in law in a 1980 Housing Act, councils have sold 127,763 leasehold properties, with 47,994 leaseholders living at another address.

The extension of the Right to Buy scheme is a contentious move by the government at a time of critical housing shortages. In July, the House of Lords voted against a move to oblige housing associations, many of which have charitable status, to sell their housing assets at a deeply discounted rate.

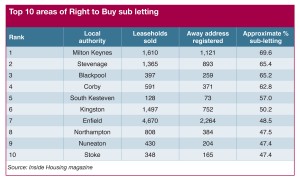

Areas with the highest number of home sales which have become buy-to-lets include Milton Keynes, Stevenage, Blackpool and Corby, with almost 70% of those sold in Milton Keynes now let privately. (see table below)

Inside Housing’s research is the first major national study – following a similar survey of 13 authorities by the Daily Mirror in 2013, and a London-wide survey by Assembly member Tom Copley last year.

In a recent speech, Brandon Lewis, housing minister, said: “We are determined to help anyone who works hard and aspires to own their own home to turn their dream into reality.

“That’s why we are committed to extending the Right to Buy to give Right to Buy-level discounts to over a million housing association tenants, with the homes sold replaced with new affordable homes.”

A news analysis from Inside Housing found a two-bedroom, ex-local authority flat on Zoopla, a short walk from Tower Bridge and the South Bank, offered for £1,712 per month. This is a 409% mark-up on the average monthly rent for a council flat in Southwark of £418.

Speaking in the House of Lords a month ago, chair of Peabody housing association and president of the Local Government Association Lord Kerslake, said he feared the Right to Buy extension would be exploited by buyers turning them into buy-to-let investments.

“Given that the average value of a Peabody property is over £350,000, it is likely that, even with the discount, sales will be to the better-off residents. Experience from local authority sales through Right to Buy is that, over time, substantial numbers of the properties are sold off, so that one-third of the homes become buy-to-let properties at market rent. These can be as much as double social rents, and so not accessible to low-income families, as was originally intended,” he added.

“If the policy is pursued in its current form, it will be contrary to the charitable intent of Peabody and housing associations like it.”

The House of Lords vote which blocked the Charities Bill, stalling the Right to Buy extension, has yet to be re-tabled, but the government may overturn this obstacle with another vote in the Commons.