RBS revealed the challenger bank made its application in October and it expects the separation of the brand from its group to be complete by summer next year. RBS said it plans to launch an Initial Public Offering (IPO) at the end of 2016.

Williams & Glyn will take with it 314 branches and around 3,000 customers according to the latest update on its website.

The government made the sale of the 314 branches a condition of its bailout package in 2008.

In April, it was announced that Jim Brown, chief executive of Ulster Bank, would take over as CEO of Williams & Glyn from John Maltby the former CEO of Kensington.

RBS’ interim management statement showed that £190m was allocated to the restructure of Williams & Glyn in Q3 this year.

The branch network of 314 is made up of 308 RBS branches in England and Wales and six NatWest branches.

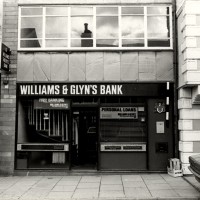

The brand was last used on the high street in the 1970s and 1980s. RBS has informed those customers who will be transferred over to Williams & Glyn that they will start to see the difference of branch branding next year.