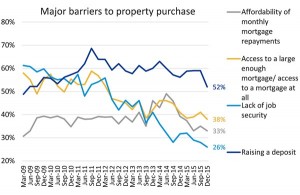

According to the Building Societies Association (BSA) property tracker UK consumers have reported that all major barriers to property purchase have fallen.

Now, 52% say they are struggling to raise a deposit against 59% in September 2015 and a high of 69% in September 2011.

From September to December 2015, access to mortgage finance as a barrier to home ownership dropped from 41% to 38%. The affordability of monthly mortgage repayments fell from 35% to 33% and lack of job security is now at 26%, down from 28%.

Paul Broadhead, BSA head of mortgage policy, said: “This snapshot of sentiment in the housing market shows that consumers are feeling reasonably optimistic about getting on or moving up the property ladder.”

He said awareness of Government schemes, such as Help to Buy and the new Help to Buy, London and wider product choice has brought new competition to the market.

But he added: “Now is the time to focus on building more homes, supported by appropriate investment in infrastructure, in order to begin to address the long term imbalance of housing supply with demand. Innovative mortgage products and intermediate forms of tenure must also be championed – not just by building societies – but by all lenders, the regulators and government.”

A Lloyds report earlier this year suggested affordability in UK cities had tumbled to 2009 levels with the average UK city house price up by 7% to £195,107.