A landlord survey suggests investors are relatively unfazed by the looming tax changes about to hit the buy-to-let sector.

Doom-mongers have suggested that changes to tax relief on monthly interest payments and the 3% increase in Stamp Duty for landlords and second-home buyers could result in many selling up and exiting the market.

However, the Council of Mortgage Lenders previewed research from YouGov which said they foresee no problems in servicing their mortgage payments, even if interest rates were to rise by 1.5%, which is more than is widely expected.

Landlords identified a range of coping strategies with higher mortgage and tax costs, with 63% saying the rental income would simply cover any higher repayments and 40% suggested they had enough cash to cover additional costs.

Of those surveyed, 11% said they would remortgage to a cheaper deal and 13% said they’d increase the rental charge to tenants.

However, the incoming tax changes are both likely to have a dampening effect on future growth prospects for buy-to-let and the private rented sector as surveys suggest landlords are less likely to buy more properties.

The Council of Mortgage Lenders also pointed out that a cumulative effect was possible, since the impact of income tax changes is ‘likely to be reinforced by the Stamp Duty changes’.

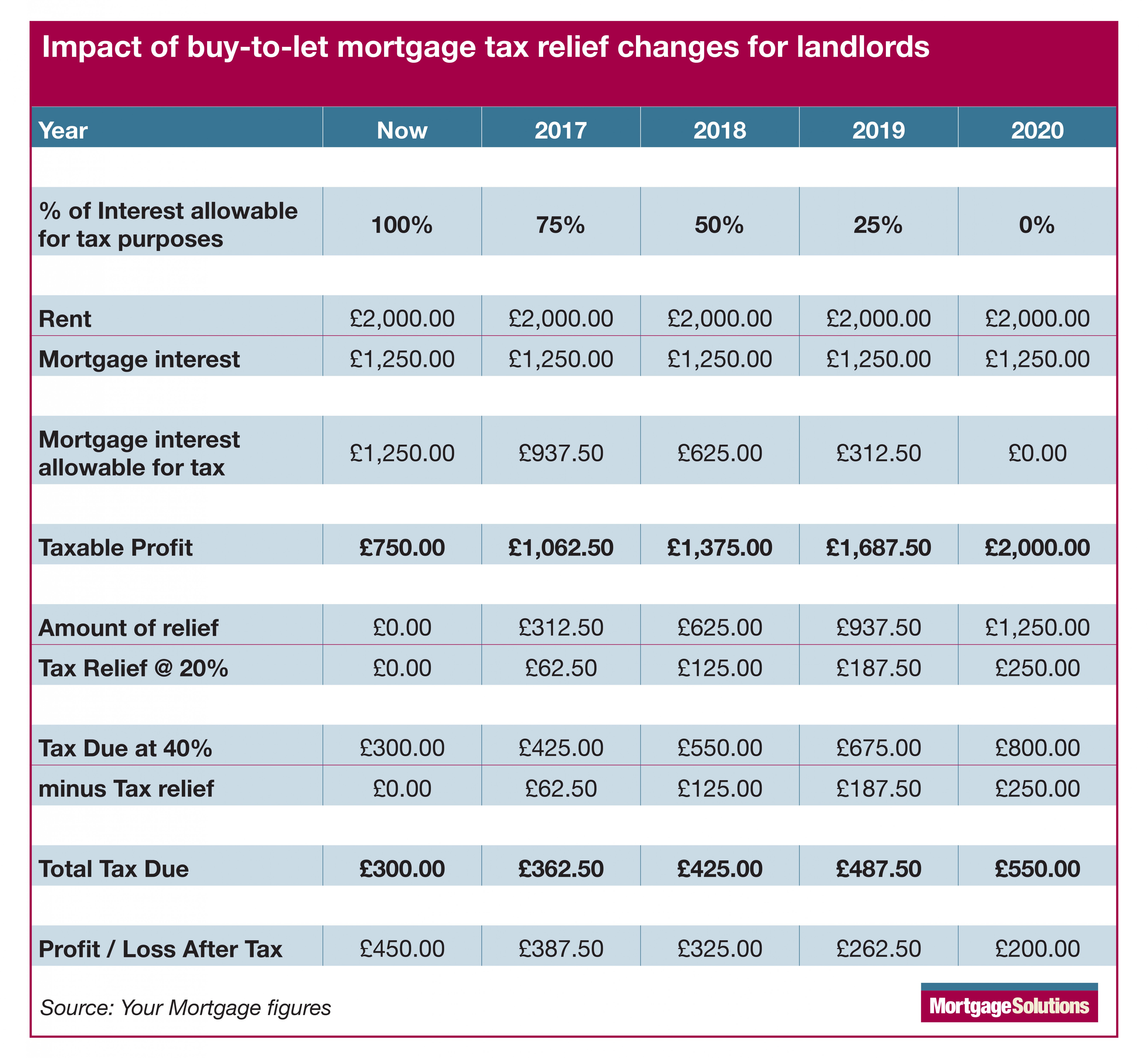

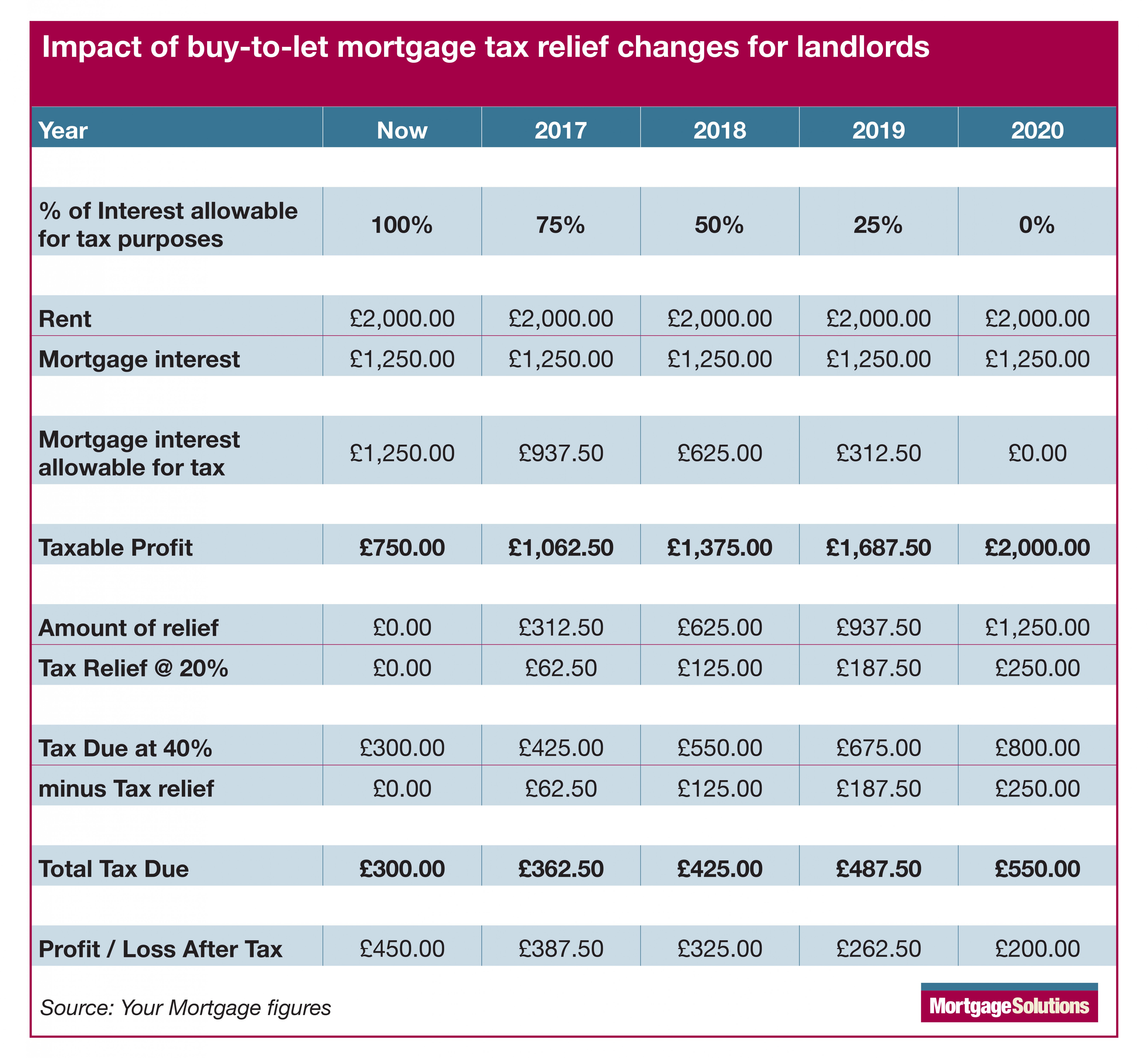

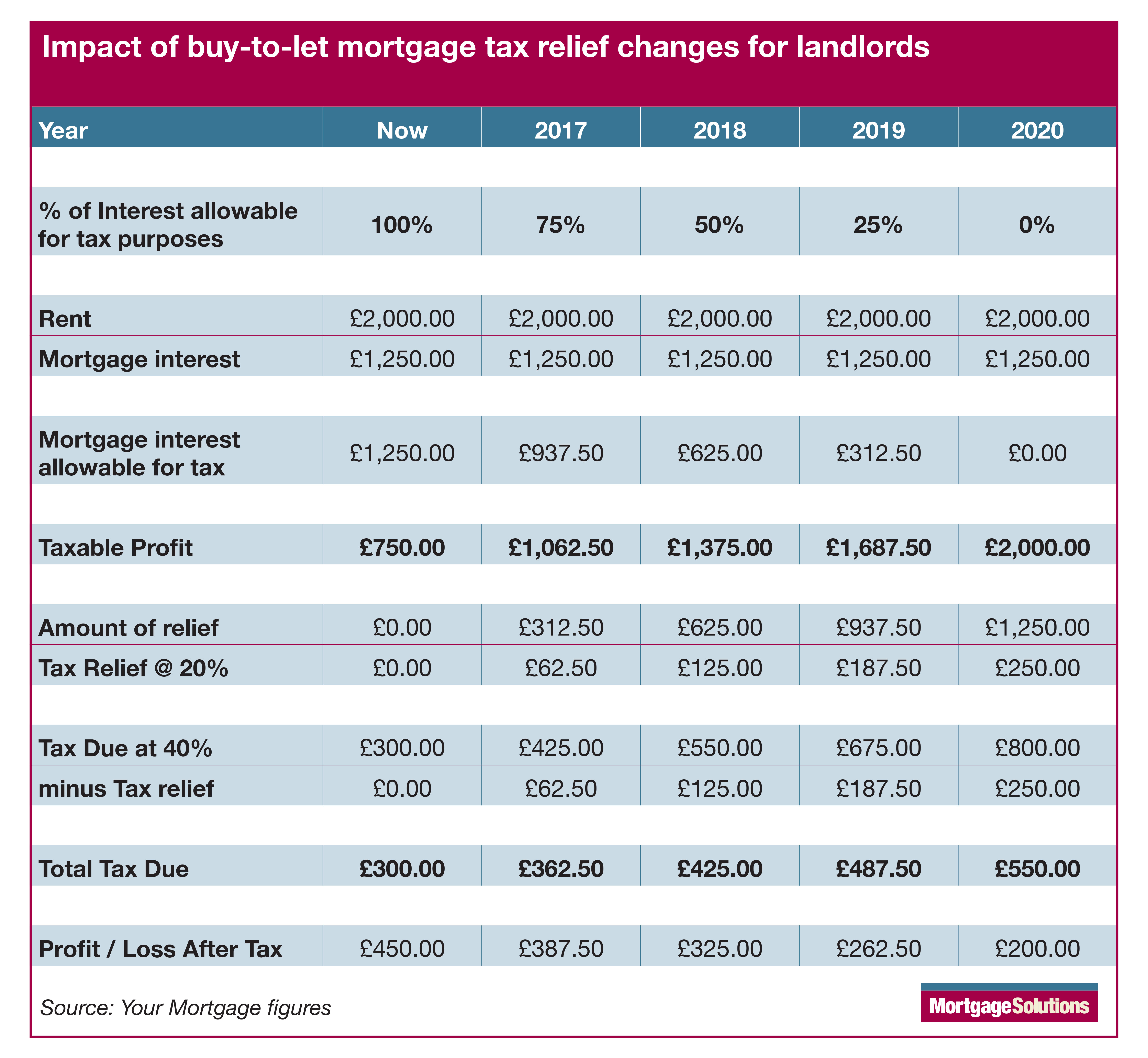

The table below offers a snapshot of the impact of the buy to-let mortgage tax relief changes.

Victoria Hartley is contributing editor at Mortgage Solutions, Specialist Lending Solutions, Your Money and Your Mortgage at London-based publishing company AE3 Media.

She has an MA in Radio from Goldsmiths after gaining a 2:1 in a Comparative American Studies BA at Warwick University. She also holds a TEFL qualification and taught overseas in Mexico and Japan from 1994 to 1997.

Her role includes editorial oversight of the news, analysis and features, event content management and strategic and editorial consultancy for the AE3 Media group. She is an experienced video, broadcast and live-event host and regularly chairs web and podcast debates and interviews.

Multiple award nominations have resulted in two wins: Santander Media Awards, trade journalist of the year and Headlinemoney Awards, mortgage journalist of the year (B2B). Here is one of the award-winning pieces: https://www.mortgagesolutions.co.uk/news/2011/07/21/exclusive-tale-bailey-fraud-witness/

Previous roles include editorships of Mortgage Solutions, consumer title What Mortgage and trade title Credit Today as well as a stint freelancing for a variety of outlets including The Guardian and Which? Money.