Speaking at the Council of Mortgage Lenders (CML) Cymru lunch in Wales, chair Julie Ann Haines said a further reason for the anticipated growth was the strong demand for government-led schemes.

“All the fundamental economic data suggests a housing market in growth, whether that’s house prices, number of first-time buyers, or very low arrears performance,” she said.

She said mortgage lending continues to rise in Wales, with more people buying houses in Wales last year than in any year since 2007.

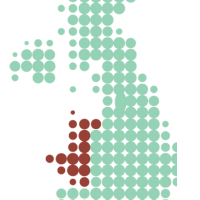

CML data found that Wales has one of the highest rates of homeownership in the UK, at 70%, compared to 65% for the UK, and has a lower proportion of inhabitants in the private rented sector, at 13.5%, than in any English region.

There are now more than 400,000 borrowers in Wales, with total outstanding mortgage debts of around £32bn meaning the average debt-to-borrower is about £80,000.

The Help to Buy – Wales shared equity scheme was recently extended, providing £290m in funding to support an extra 6,000 purchases up to 2021.

However, Haines said that there were new pressures on housing in Wales with increased regulation and uncertainty in the Welsh steel industry.

“We’re seeing more demands than ever on lenders on the regulation side, with the introduction of the Mortgage Market Review and the European Credit Directive, but also on the consumer side with greater needs for innovation, a demand for more diverse range of banking platforms in a digital age, and more individualised products.

“Moving forward, we must address the barriers to housing supply and work with government and regulator to ensure we provide appropriate affordable housing across Wales,” she added.