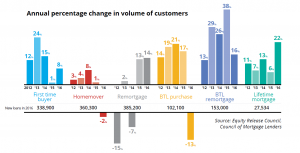

A total of 27,534 new plans were agreed in 2017, up 22%, although it remains a small segment of the overall market. This growth beat all other areas of the mortgage market. (Click graph to enlarge.)

A total of 27,534 new plans were agreed in 2017, up 22%, although it remains a small segment of the overall market. This growth beat all other areas of the mortgage market. (Click graph to enlarge.)

The Equity Release Council’s Market Report noted that there had been a significant fall in average equity release rates over the year to January of 75bps (from 6.20% to 5.45%), with many providers now offering rates below 5%.

Drawdown mortgage products continued to be the most popular type of equity release plan in 2016; 65% of new customers opted for drawdown compared to 35% taking lump sum mortgages.

The report also found the proportion of older equity release customers was rising.

Between H1 2016 and H2, the share of those aged 75-84 and also 85 and above both increased slightly, while the proportion of customers aged 55-64 remained stable.

Significant year

Equity Release Council chairman Nigel Waterson (pictured) said 2016 was a hugely significant year for the equity release sector.

“The value of lending has nearly tripled in the five years from 2011 to surpass the £2bn mark, and we also celebrated the 25th anniversary of the industry standards which have been fundamental to establishing a safe and reliable market for consumers.

“The sector is becoming increasingly mainstream amid growing appetite from older homeowners, reflected by the fact that lifetime products were the fastest growing segment of the mortgage market last year.

“Older homeowners are increasingly realising that there are a number of potential uses for their housing wealth beyond supplementing their retirement income, including re-investing in their homes and helping younger family members by providing a living inheritance.”

He added that greater flexibilities and growing competition meant products were continuing to evolve, the council was committed to ensuring best practice in advice and product delivery.

Strong fundamental growth

Stephen Lowe, director at Just, said the sector’s continued development was built on solid foundations.

“The growth is driven by strong fundamentals – demographics, economics and consumer need,” he said.

“And the demand is being met with increased supply as new entrants join the market to provide customers with more choice and competition.

“People are becoming more disposed to using the equity in their homes to improve their later life or that of their close families. We are seeing increasing numbers of customers topping-up their retirement incomes to make life a little more comfortable,” he added.

More 2 Life channel marketing director Stuart Wilson noted that the full impact of pension freedoms was beginning to emerge, with retirees including property wealth in their holistic financial planning.