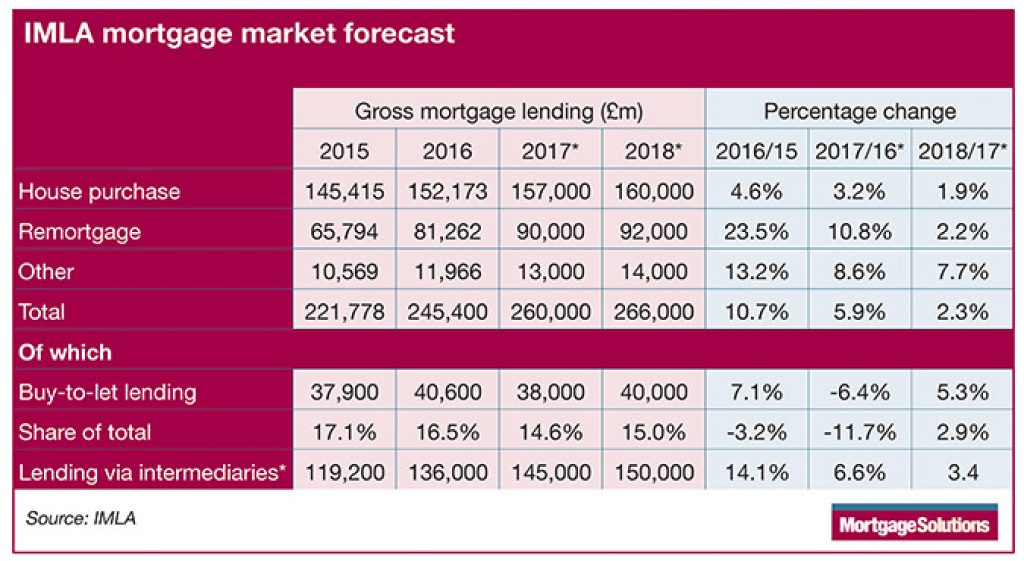

This decline has been driven by a fall in buy-to-let lending for house purchase, which IMLA expects will fall by nearly 17% in 2017 to £12.4bn.

According to the trade body white paper – ‘The new normal – prospects for 2017’ – IMLA believes that the buy-to-let market has bottomed out and that lending will rise modestly to £40bn in 2018.

While the policy changes are likely to continue slowing down buy-to-let lending for purchase, they could stimulate buy-to-let remortgage lending as the restriction on the deduction of mortgage interest will increase higher rate taxpayers’ incentive to seek out lower mortgage rates. In 2016, buy-to-let remortgage lending hit a record £25bn, which represents 62% of all buy-to-let lending and 31% of all remortgage lending.

The mortgage market is expected to achieve the highest level of gross lending since before the financial crisis this year.

£260bn lending

The IMLA paper predicts that total gross mortgage lending will reach £260bn in 2017. This is 5.9% higher than the £245bn recorded by the CML in 2016.

Meanwhile, trade body expects net mortgage lending to hit £45bn this year, which is the highest level recorded since 2007. This suggests the total stock of mortgage debt will grow by 3.4% this year – slightly outpacing the growth of disposable income expected by the Office for Budget Responsibility (OBR).

Despite the Brexit vote, several different factors have contributed to the continued strength of the mortgage market, including an imbalance between supply and demand, modest rises in inflation and the low Bank of England Base Rate. This has improved mortgage affordability and made consumers more relaxed about taking on greater levels of debt.

The average homeowner is spending 7.2% of their income on interest payments, while first-time buyers spent an average of 9.1%. These good conditions are likely to persist, said IMLA.

Shaking off turbulance

Peter Williams, IMLA’s executive director, said: “The mortgage market shook off uncertainty and turbulence to register another solid year in 2016, and IMLA predicts that the market is set to do the same again in 2017.

“Looking ahead, this momentum in the market is unlikely to be derailed any time soon. While the General Election in June could lead to further uncertainty, and the outcome of the Brexit negotiations are still unclear, the mortgage market is in rude health and the strong fundamentals underpinning it are unlikely to change.”

IMLA’s latest white paper predicts that the remortgage market will continue to be the most buoyant part of the market over the remainder of 2017 and into 2018. In total, the trade body expects remortgage lending to reach £90bn in 2017, which is 35% of overall lending. In 2018, remortgage lending is forecast to grow to a total of £92bn.

Increased scrutiny

The buy-to-let market, on the other hand, has struggled under the burden of increased regulatory scrutiny over the last year, with the restriction on landlords’ mortgage interest deductibility and the 3% Stamp Duty surcharge both affecting its performance.

Williams said: “Different segments of the mortgage market had contrasting years in 2016. The remortage market performed very well, with existing borrowers eager to take advantage of rising house prices and low rates by securing a new deal.

“However, with lenders increasingly encouraging product transfers, it will be interesting to see if the remortgage market maintains this momentum in the long-term.

“The buy-to-let market suffered under the changes introduced by the Cameron government, but ultimately demand for private rented accommodation means that lending volumes are likely to rise again in the future. While the changes have certainly made things more difficult for landlords, property remains an attractive and comparably stable investment, which will support long-term growth in the sector,” he added.