Homemovers borrowed £6.2bn, down 33% year-on-year while some 30,200 loans were advanced to existing property owners, down 28% compared to March 2016.

The Council of Mortgage Lenders (CML) data, however, showed that activity in the homemover market was improved compared to February with lending up 19% and loan volumes up 24%.

Remortgaging market powers ahead

Remortgaging in March grew on both a monthly and yearly basis. Transaction volumes rose 14% monthly and 24% yearly to reach 35,500. The value of remortgage lending was £6bn in March compared to £5.3bn in February and £4.9bn in March 2016.

Paul Smee, director general of the CML, said: “The relatively sluggish activity among homemovers stands in contrast to the growth in first-time buyer and remortgage activity, but in aggregate the market is showing broadly the levels of activity we expected. As we head into the summer, we expect a continuation of these trends, with both first-time buyer and remortgage lending expected to maintain momentum in the light of the very attractive deals currently available.”

“business is heavily loaded towards people remortgaging”

Paul Flavin, managing director of mortgage brokerage Zing Mortgages, has witnessed a definite shift in business away from people moving home towards improving their existing home.

“Processing over 80 mortgage applications each month gives you a fair feel for the local market and, although we are busy, the spread of business is heavily loaded towards people remortgaging to get a better rate, or raising additional funds to complete home improvements,” said Flavin. “The number of mortgages we’re completing for people purchasing property is definitely down.”

Flavin said the lack of confidence in where we are heading as a nation seems to mean that more people are choosing to invest the money they would save in Stamp Duty and moving costs into extending their current property.

He added: “After all, if they like the area and feel settled why not spend £80,000 on a loft and rear extension rather than giving probably half of that amount to the government and the estate agent.

“Although I’m confident that the long-term future of the market is one of growth, I do feel that in the short term it may not be business as usual or we need to re-evaluate what the new normal is.”

Strong first-time buyer market

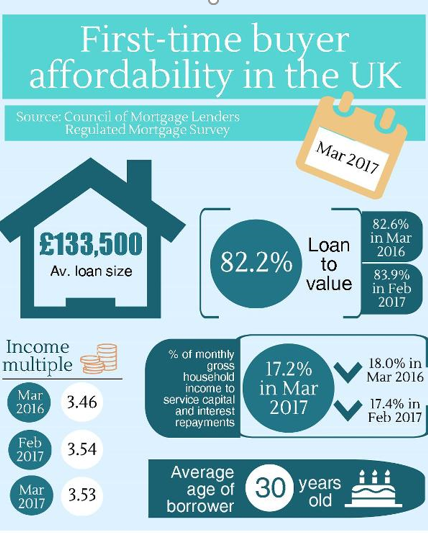

First-time buyer activity grew monthly and yearly in March despite a rise in the average income multiple and no change in average income.

First-time buyers borrowed £4.9bn for homeowner house purchases, up 29% on February and 9% on March 2016. They took out 31,500 loans, up 30% month-on-month and 12% year-on-year.

Brian Murphy, head of lending for Mortgage Advice Bureau, said: “The report released from the CML this morning presents a pretty positive picture, with first-time buyer lending up in March both month on month and year on year; but the really good news is that more first-time buyers secured lending in March 2017 than they did in March 2007.”

Affordability metrics for first-time buyers saw the typical loan size increase slightly from £132,200 in February to £133,500 in March. The average household income remained the same month-on-month at £40,000. This meant the income multiple went from 3.54 to 3.53.

The average amount borrowed by home movers in the UK decreased to £172,000 from £176,000 the previous month, while the average home mover household income decreased slightly month-on-month from £55,000 to £54,100. The income multiple for the average home mover was unchanged at 3.34.