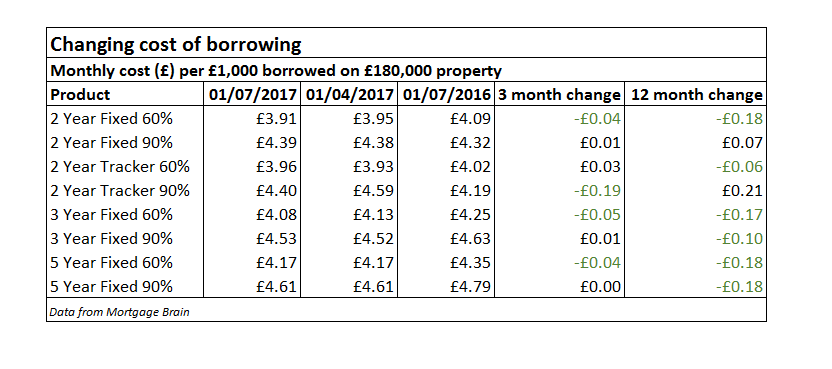

The firm’s quarterly product data analysis found only a handful of product types have seen rates increase in the last quarter. On an annual basis five-year fixed rate costs have fallen by as much as 5.56% (click to expand table below for full details).

Mark Lofthouse, chief executive of Mortgage Brain, said that while the reductions in costs seen over the last three months were relatively small, they followed a period of stability and represented “welcome news” to borrowers.

He continued: “Our longer term analysis of the most popular mainstream mortgages also shows a strong mix of rate and cost reductions which means that borrowers looking to take out a mortgage today can benefit from lower monthly repayments.”