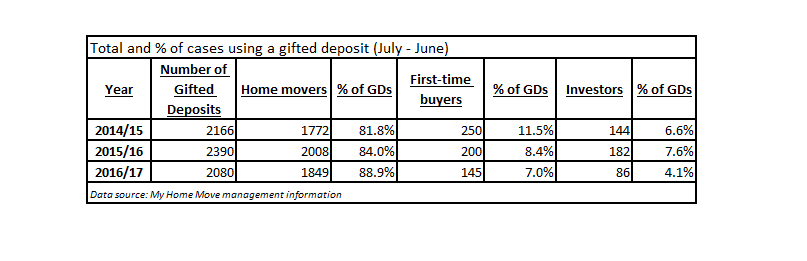

As a result, home movers accounted for almost 90% of all transactions involving gifted deposits between July 2016 and June 2017, according to conveyancer My Home Move.

However, gifted deposits still account for around 8% of all property transactions, suggesting that more than 100,000 people still needed help from parents or grandparents.

My Home Move warned that it was clear that affordability was becoming a concern not just for first-time buyers, but for people on all rungs of the property ladder.

The number of people using a gifted deposit peaked between July 2015 and June 2016 at 2,390 in the run up to Stamp Duty Land Tax (SDLT) changes.

Falling numbers

However, the My Home Move data showed this total had slipped back 13% in the last 12 months to 2,080 cases.

Although the number of home movers using gifted deposits has dipped slightly, it is first-time buyers and investors which have shrunk most. (see graph below – click to expand)

The number of first-time buyers and investors using gifted deposits has fallen by 42% and 40% respectively in the last two years.

The pair now combine for just 11.1% of all gifted deposits compared to 18.1% in 2014/15.

In contrast, home movers increased from 81.8% to 88.9% of all gifted deposits in the two-year span.

Earlier this week, Royal London published a guide warning parents about the tax risks of gifting deposits.

Affordability key issue

My Home Move CEO Doug Crawford said the drop in gifted deposits to first-time buyers was particularly interesting as it was well-known that affordability was a key issue for this group.

“With gifts to this group falling steadily, it does beg the question as to whether this is reflective of a drop in the number of first-time buyers entering the market, or whether there are other factors in play,” he said.

“We already knew that the main beneficiaries of gifted deposits were people that were already on the property ladder, but the data seems to suggest that these second-steppers and middle-movers are in more and more need of help to make it onto the next step.

“As house prices have risen by almost 18% in the timeframe that was analysed, it may be that people are struggling to accumulate enough equity from the home that they are in now to raise a deposit on their new property.

“The average property deposit is now close to £60,000, so it’s likely that the Bank of Mum and Dad is stumping up the additional funds needed to help their children into bigger properties,” he added.