The researchers believe evidence suggests that wealth effects on spending have faded, especially in the US and the UK.

Valuations only look stretched in a few Organisation of Economic Cooperation and Development (OECD) countries and instead, the report warned that the China market should be of greater concern.

3.5% growth

Last week, Oxford Economics predicted that UK house prices would remain sluggish until 2021, only rising about 1% during this time.

Its newly published GDP-weighted measure showed real global house price growth was running at around 3.5%, a “solid but not dramatic pace”.

Although it acknowledged there was much cross-country variation, researchers agreed rapid house price growth could justify tighter monetary policy if it foreshadowed stronger domestic spending, including via wealth effects.

However, they noted that these wealth effects may be weakening, especially in economies like the US and UK where mortgage equity withdrawal has historically underpinned spending but is now minimal.

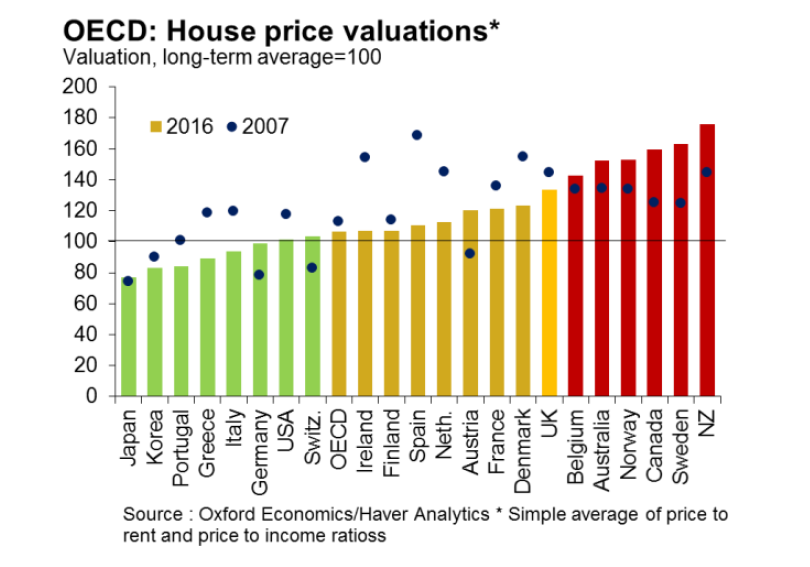

They highlighted that policy makers also tended to fret about financial stability from potential house price crashes after excessive valuations, but argued that only New Zealand, Sweden and Canada seemed particularly over-valued at present. (see graph. Click to expand.)

Beware China

Instead, the researchers warned that China’s housing sector was more of a concern to the global economy.

“Booming real estate markets in China have underpinned the upturn in demand there over the last year or so but seem to be cooling now,” the report said.

“This could weigh on Chinese imports and global commodity prices, curbing the global cyclical upturn – and a look at past Chinese house price cycles suggests a risk that price growth could retreat quite sharply.

“This downside risk looks more significant to us than frothy housing markets in a few advanced economies, given China’s central role in generating the recent world upturn.”