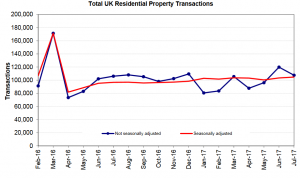

Although the seasonally adjusted figure for July from HM Revenue and Customs of 104,760 residential transactions was 8.3% higher than July 2016, it was on a par with July 2015.

HMRC cautioned on making comparisons between July 2017 and July 2016 as some taxpayers may have changed their behaviour following the result of the June 2017 General Election and the EU referendum in June 2016. (See graph. Click to expand. Source: HMRC)

Reliable indicators

Commentators noted that transaction levels could often be a more important and reliable indicator of the health of the housing market than other indices such as prices, which can boom and bust.

Former Royal Institute of Chartered Surveyors residential chairman and north London estate agent Jeremy Leaf noted: “While the seasonally-adjusted HMRC numbers are nothing to get particularly excited about, they do show a relatively stable market and reflect what we are seeing on the ground.

“The figures compared with last year are misleading, however, because this time last year the market was in the doldrums following the imposition of the Stamp Duty surcharge.

“Looking forward we are expecting more of the same with buyers and sellers negotiating hard to get sales through. Those who aren’t prepared to see the reality of the present market will be left behind,” he added.

Flat market

Legal & General Mortgage Club director Jeremy Duncombe echoed these views and bemoaned the lack of house building.

“With a lack of new stock coming onto the market, property transactions have remained flat for quite some time now.

“The Lloyds Homemover report published yesterday revealed homemovers now account for just over half of the housing market, compared to 64% a decade ago.

“Rather than selling their house, families are deciding to stay put in their current homes and paired with today’s result, this highlights the effect that a chronic lack of housing is having on the UK’s housing market.”

He added that the “UK property market is unlikely to grind to a halt, as low interest rates continue to keep demand high, but ultimately the government needs to address the ongoing issue of supply”.