For example, the tax increases intended to reduce demand for buy-to-let property; the Help to Buy scheme, and the recent stamp-duty break for first time buyers have actually resulted in an increase in house prices at the lower end.

L&C has forecast an increase in the average first-time buyer deposit from £51,821 to £65,930 by 2022, which is 27%. This may rise even higher, if the impact of interest rate rises on affordability calculations results in lenders becoming more cautious and demanding higher percentage deposits.

In addition, the Office for National Statistics has calculated that the value of land has risen by 412% since 1995. This dwarfs the rise in the average house price. As land can account for up to 70% of the cost of a property, there is definitely pressure on the prices of new build homes as the cost of labour and materials increase.

In addition, this may impact the London market if there is some movement on brownfield sites and land banks held by major builders.

Demand and affordability

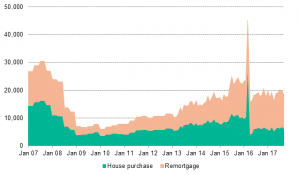

The demand for residential investment properties isn’t going away. Figures released by UK Finance state that, for Q3 2017 “Gross buy-to-let lending totaled £9.3bn, up 11% on the second quarter and four per cent on the second quarter of 2016.”

While the majority of these figures relate to remortgaging; there remains a solid base of purchases. However, these figures do not include cash purchases or conversions where no remortgage was required.

Another factor is the house price to earnings ratio. Despite lower than average wages, this ratio is substantially lower in areas such as Nottingham, Sheffield, Liverpool, Newcastle and Glasgow than it is in Southern England. Thus, whilst there already is some adjustment in London and the South East, other areas will continue to show rising property prices. This is, of course, dependent on employment opportunities.

Overall, there should be no reason for lenders to panic and I expect bridging lending to continue to grow, if not at previous rates.