Last month Mortgage Solutions reported that brokers were increasingly seeing higher income multiples from lenders.

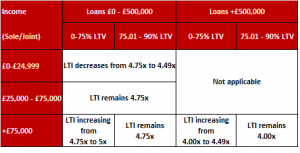

Most of the Scottish Widows Bank changes occur on loans up to £500,000 and all apply on total applicant income, whether sole or joint.

For borrowers earning under £25,000, the maximum loan to income (LTI) is being cut from 4.75 times to 4.49 times. This applies for all loan-to-value (LTV) levels.

Higher earners

Multipliers for those earning more than £75,000 who are applying for up to 75% loan to value (LTV) will increase from 4.75 times to five times.

It will be unchanged at up to 4.75 times income for more than 75% LTV products.

And for higher earners targeting loans over £500,000, the LTI is increasing from four times to 4.49 times at up to 75% LTV.

For borrowers earning between £25,000 and £75,000 the LTI remains unchanged.

Scottish Widows Bank managing director Neil McLellan said: “In an environment where house prices have continued to increase year on year whilst earnings have stayed relatively flat, adapting our policy in this way will help us provide greater choice for brokers to meet the needs of their customers in today’s market.”