David Bird director of Online Mortgage Advisor, said this is mostly due to traditional and outdated preconceptions about mortgage eligibility.

Previous market conditions that dictated a very conservative lending policy no longer apply but this has not been effectively communicated to consumers, he said.

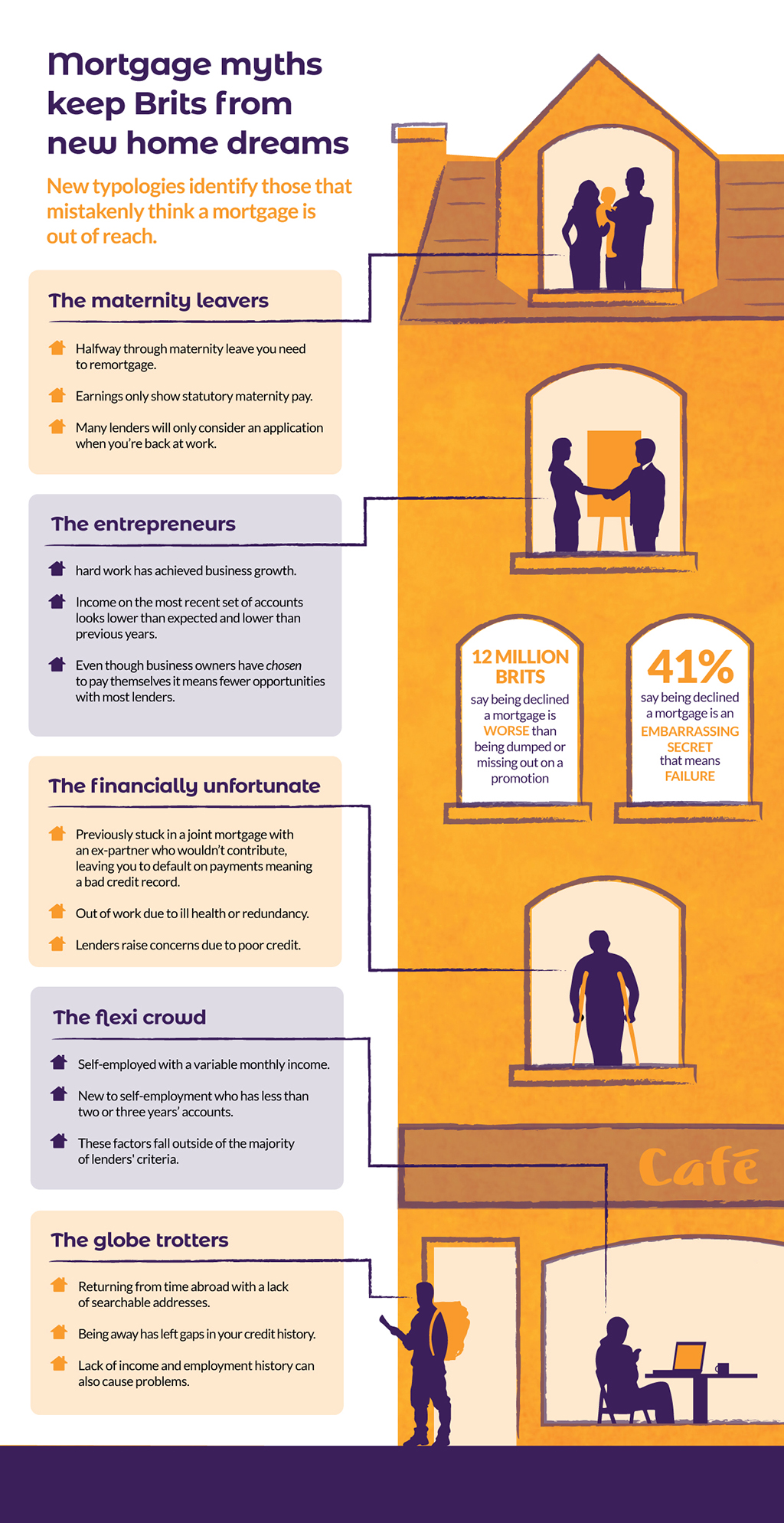

This has led to preconceptions about self-employment, flexible working, working abroad, financial difficulty and maternity leave, which have led to 35% of respondents assuming they don’t earn enough to be approved for a mortgage and 33% stating that the mortgage approval process is too complicated, meaning potential homeowners are not getting on the property ladder.

Flexible lives demand flexible mortgages

There are increasing calls for the mortgage market to accommodate changing consumer habits as work becomes more flexible and global.

With up to 4m people identifying as self-employed alone, meaning that they have varied income or lack annual accounts, it has become more important than ever to create adaptable mortgages that can cater to more complex needs.

Bird, added: “Despite this fantastic pace of change, unfortunately the mortgage market has not necessarily kept pace…..Advice varies enormously between brokers and criteria varies significantly from lender to lender. When one person goes to a broker that fails to secure a mortgage or applies directly to the wrong lender, they presume this goes for everyone and tell their family and friends so”.

However, this doesn’t have to be the case. Online Mortgage Advisor has identified five kinds of people that may assume they were ineligible for a mortgage. These include entrepreneurs, the self-employed, globe trotters, the financially unfortunate and maternity leavers’ who due to their varied income, employment history or perceived poor credit mistakenly thought a mortgage was out of reach.

Online Mortgage Advisor said it is actively targeting and specializing in these kinds of borrowers to encourage more people to get on the property lad

der.