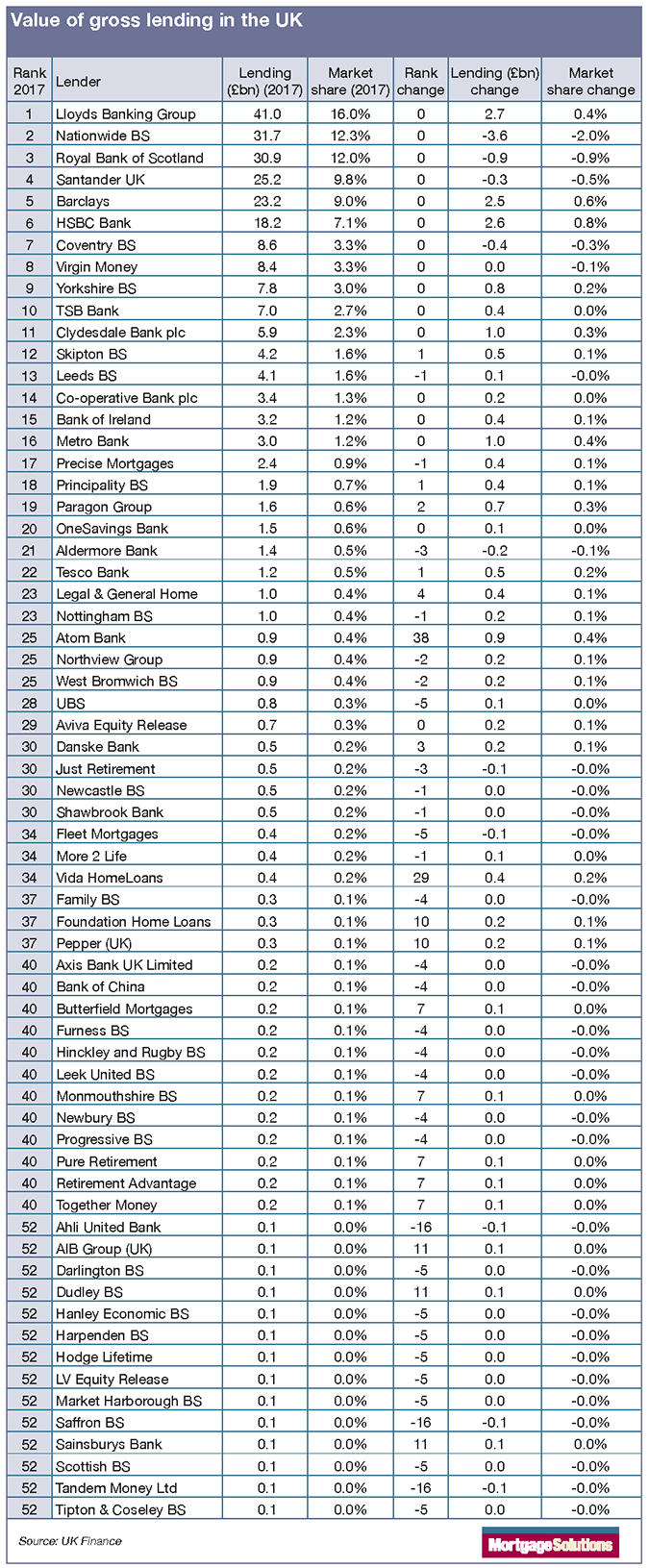

Meanwhile, in a reversal of fortunes from 2016, Nationwide Building Society saw the largest dip in lending volume and market share last year, according to the latest UK Finance data.

However, despite the fluctuations in lending volumes and market share, the top twenty lenders remained largely unchanged in their ranking – with Lloyds still the biggest lender, breaking the £41bn barrier.

For 2017, gross lending totalled £257bn, up 4% on 2016 – a slower rate of growth than the 11% in 2016.

UK Finance noted that despite this it had seen increased competition for mortgage business with 65 lenders completing at least £50m worth of lending, up from 60 lenders in 2016. (See table below.)

The trade body data showed that growth in new lending was strongest among lenders ranked 21-30 in 2017, who lent £3bn more than 2016’s 21-30 group – a growth rate of 40%.

UK Finance analyst Callum Bilbe said: “It’s clear that while all types of lenders did see an increase in their lending overall, it is the challenger banks and specialist lenders who are doing the most new business proportionately with almost a 20% increase in activity.”

Big six mix

In contrast, while the big six lenders grew gross lending by £3bn, this was a rise of just 1.8% – and their market share also slipped by 1.6%.

But this masked differing performances between the six.

Lloyds, Barclays and HSBC grew their lending by £2.7bn, £2.5bn and £2.6bn respectively, with market share gains of 0.4%, 0.6% and 0.8% respectively.

Nationwide saw its lending drop by £3.6bn resulting in a 2% fall in market share.

Royal Bank of Scotland and Santander also witnessed dips in lending volumes, though both were less than £1bn with 0.9% and 0.5% falls in market share respectively.

Big movers

There were also some notable performances by mid-market and smaller lenders.

Metro Bank broke the £3bn barrier as it added a further £1bn to its gross lending – a 50% increase to maintain 16th position.

Paragon Bank saw a 78% rise in lending activity, moving to 19th from 21st, Legal and General also made a sizeable jump, moving from 27th to 23rd place following a 67% increase in lending.

Tesco Bank achieved a 71% lending increase to hit £1.2bn and take 22nd place.

Atom Bank jumped straight into the top 25, completing £900m of business in its first full year of lending after launching its proposition in December 2016.

Vida in its first full year of lending soared 29 places to joint 34th, completing around £400m worth of lending.

Meanwhile, Foundation Home Loans and Pepper both doubled their lending to hit £300m and jump 10 places to joint 37th.

Market predictions

UK Finance also said most recent market data indicated mortgage lending was performing slightly better than it had expected, but this was not certain to continue.

“In our most recent market forecasts we predicted gross lending of £260bn in 2018 – an increase of about 2%,” Bilbe continued.

“Lending in the early months of 2018 has, so far, outpaced our forecasts, driven largely by stronger-than-expected remortgage activity. The uncertainties we set out last year – not least those relating to the UK economy – remain; these have the potential to affect the path of lending for the rest of this year and beyond.

“However, the market has shown this year that, yet again, it is competitive and robust enough to continue to help UK mortgage customers as their needs change,” he added.