The second remortgaging spike in a decade closely followed the latest interest rate rise, with over 25% of brokers expecting the market to grow even further in the second half of the year.

An Intermediary Mortgage Lenders Association (IMLA) poll suggested 11% of advisers also expect another rate rise before the end of the year.

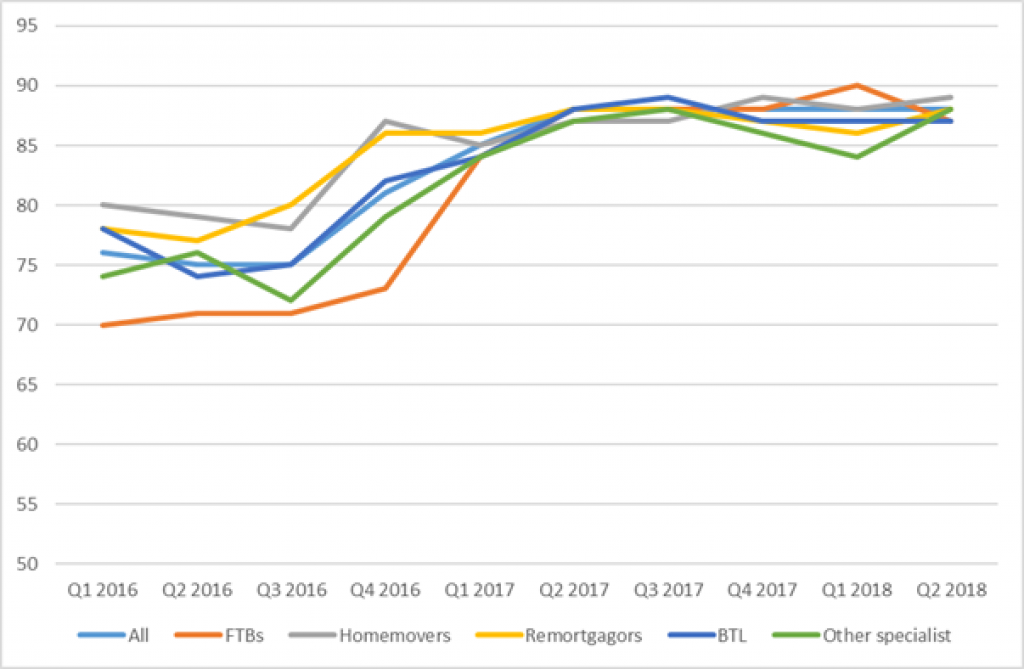

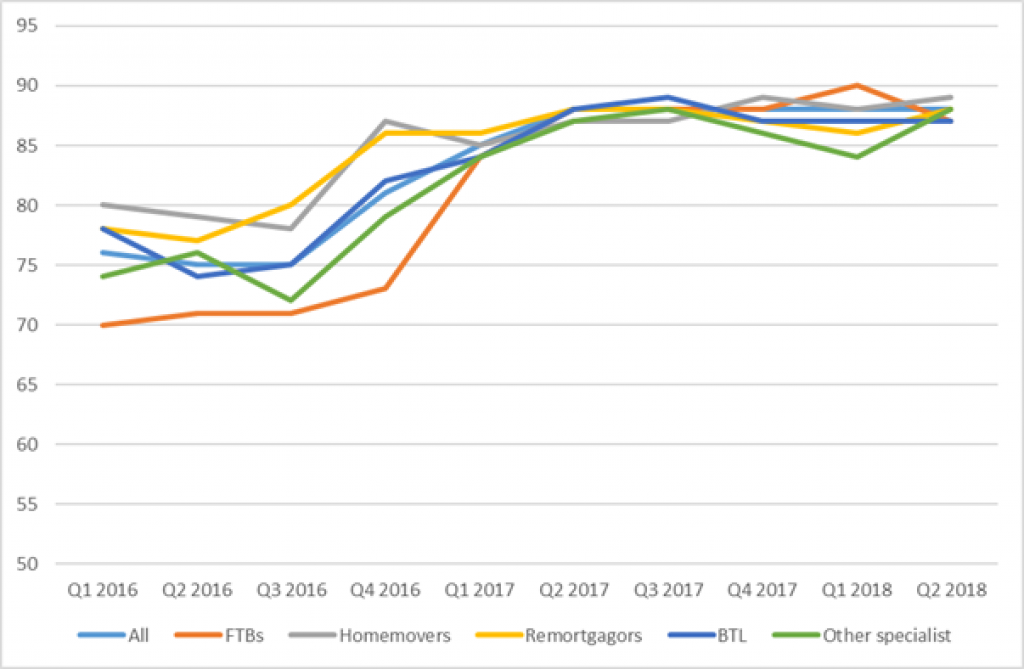

Over three quarters of remortgage applications via intermediaries resulted in a completion during Q2 2018 – up from 70% in the previous quarter – as activity spiked ahead of the Bank of England’s widely-anticipated rate rise to 0.75%.

A similar spike in activity occurred in Q3 2017 – ahead of the first rate rise in a decade in November, from 0.25% to 0.5%.

The IMLA research, which harnesses data from BDRC Continental, revealed almost nine out of 10 mortgage offers involving cases placed through brokers led to offers.

Progress of remortgage applications to offers and completions

Borrowers spurred to action

The volume of remortgages in June also increased by 8.4% compared to a year earlier, as homeowners prepared for the Bank of England’s decision.

Kate Davies, executive director of IMLA, said: “While customers who remain on tracker and standard variable rates are having to adjust to a second increase in monthly loan repayments in twelve months, competition in the market remains strong and should ensure keen and competitive pricing.”

Victoria Hartley is contributing editor at Mortgage Solutions, Specialist Lending Solutions, Your Money and Your Mortgage at London-based publishing company AE3 Media.

She has an MA in Radio from Goldsmiths after gaining a 2:1 in a Comparative American Studies BA at Warwick University. She also holds a TEFL qualification and taught overseas in Mexico and Japan from 1994 to 1997.

Her role includes editorial oversight of the news, analysis and features, event content management and strategic and editorial consultancy for the AE3 Media group. She is an experienced video, broadcast and live-event host and regularly chairs web and podcast debates and interviews.

Multiple award nominations have resulted in two wins: Santander Media Awards, trade journalist of the year and Headlinemoney Awards, mortgage journalist of the year (B2B). Here is one of the award-winning pieces: https://www.mortgagesolutions.co.uk/news/2011/07/21/exclusive-tale-bailey-fraud-witness/

Previous roles include editorships of Mortgage Solutions, consumer title What Mortgage and trade title Credit Today as well as a stint freelancing for a variety of outlets including The Guardian and Which? Money.