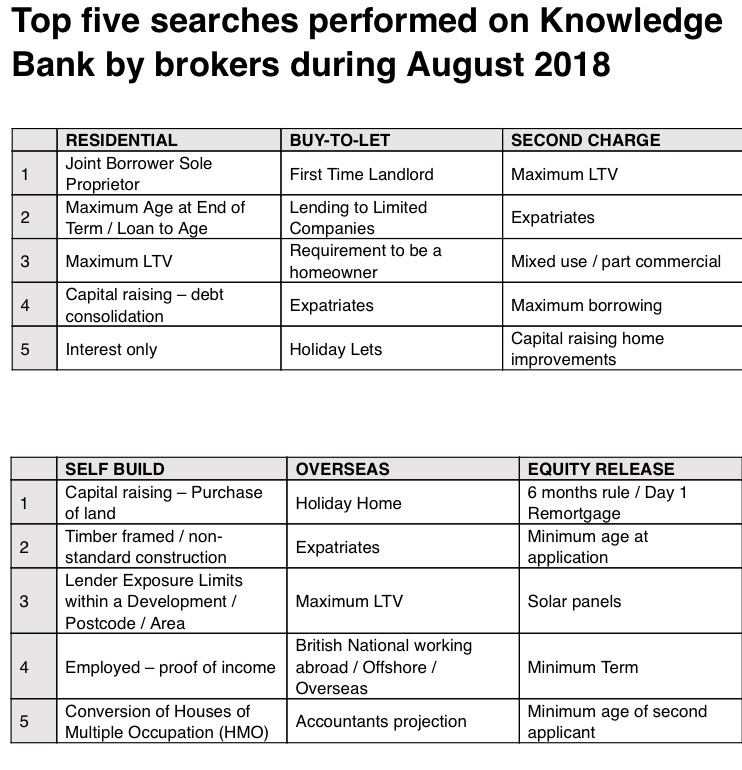

Other top residential mortgage searches included the maximum age allowed at term-end, maximum LTV and a search for lenders who allow capital raising for debt consolidation, according to the latest Criteria Activity Tracker from Knowledge Bank.

On buy to let, this month’s rankings remain fairly consistent from July, although the search for lenders who accept first-time landlords takes the top spot for the first time.

This is followed by lending to limited companies, requirement to be a homeowner, expatriates and holiday lets.

Other results of note include the self build sector where the top search conducted is for lenders allowing capital raising for land purchase, which suggests a continuing appetite for this market.

In the second charge sector, the most searched criteria was the maximum LTV, followed by expatriates and mixed use or part commercial.

Expatriates showed up in the top five most searched criteria also in the overseas sector, whereas in equity release, it was the six month rule or first day of remortgage, followed by minimum age of application and solar panels.

Nicola Firth, CEO of Knowledge Bank (pictured), said there has been no let up in broker’s activity in their effort to see where their clients will fit ever-changing lending criteria, despite August being a traditionally a quiet month in the industry.

“Feedback from brokers over the month suggests that because of the base rate increase borrowers have a greater than before level of uncertainty about the products on offer and their ability to qualify for them. Coupled to this is evidence of a raft of lenders tweaking and refining their criteria in tandem with price changes as a result of what is only the second base rate rise in over a decade.

“This market uncertainty is a perfect example of where criteria sourcing can pay huge dividends. Brokers seem to be really switched on to the fact that a quick source of criteria against a client’s circumstances can offer reassurance for exiting applications and also generate new lending opportunities.”