The automated adviser called Ava conducts the initial fact find, answers borrowers’ questions and produces a decision in principle while assessing eligibility for the Help to Buy scheme.

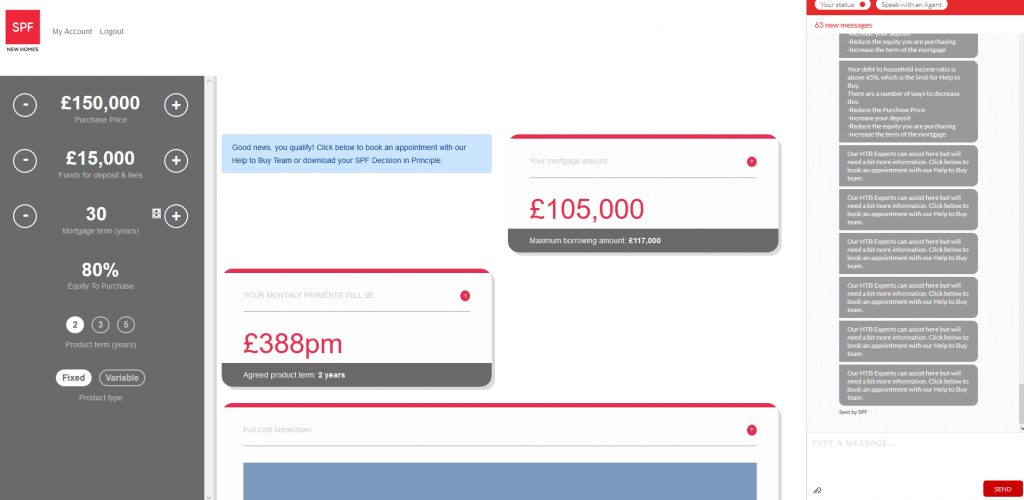

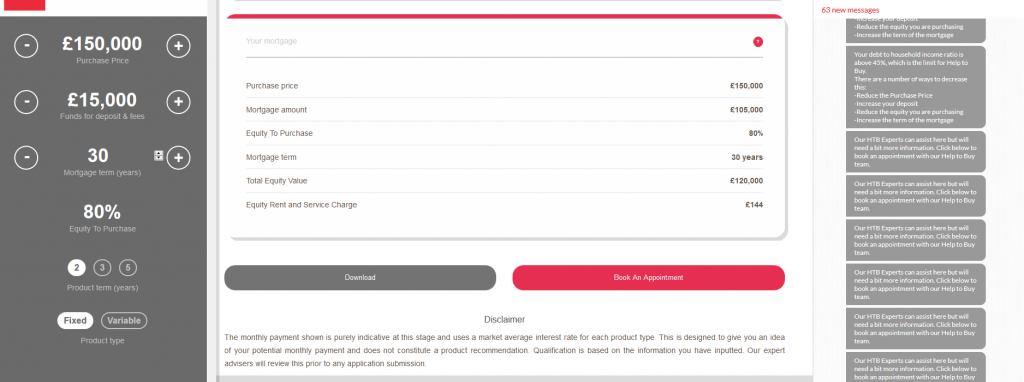

This includes giving an indicative monthly payment based on Help to Buy products available (see image below).

An appointment with an adviser is booked to run over any questions at that stage.

The client then continues uploading documents which are analysed by Ava and completes a full fact find, then the adviser speaks to the client to find the best products based on everything they have covered online.

Learns questions and answers

The system, which has been built using IBM Watson and IBM Cloud, offers a hybrid human chat facility.

It is trained on 200 common questions regularly received by advisers and knowledge from the Certificate in Mortgage Advice and Practice (CeMAP), offering “quick, clear answers” in the early stage of buying.

By analysing tone and confidence in client messages, it will ensure that clients needing extra support are handed over to an adviser.

“Over time and with built-in machine learning functionality, the virtual assistant gets smarter and better at advising on Help to Buy mortgages,” SPF said.

“As new questions come in, Ava alerts the advisers who can jump in to connect with the client and it learns the answer remembering it for next time.”

Cut five days off

SPF believes the process could cut the time to be connected to an adviser for a full mortgage recommendation from five days to around 30 minutes.

“Ava was created to handle the significant increase in enquiries from first-time buyers looking to take advantage of the government’s Help to Buy scheme and the added complexities of the eligibility criteria,” the broker firm said.

“Ava is enhancing the role of traditional brokers, enabling them to spend more time conducting analysis on new developments and properties and building relationships with banks to secure the best lending rates for clients.

“It has allowed SPF Private Clients to have more informed conversations with clients and deliver better client service,” it added.

Manage different client scenarios

SPF Private Clients digital architect Freddie Savundra said: “Lots of people want help understanding how much they can afford through the Help to Buy scheme and how each stage of the mortgage application process works.

“With Ava, we can guide them at every step, giving them confidence that they’re in the best possible hands.”

He added that combining live and bot chat allowed the firm to manage a number of different client scenarios in one interface.