For many savers 5 April signifies the final rush to allocate to their pension or ISA. Looking ahead, there are a host of changes due to come in.

As we mark the start of the new tax year tomorrow, here are four personal finance changes that are set to come in:

1. Auto-enrolment: pension contributions rise to 8%

Since the auto-enrolment rules were introduced in 2012, more than 10 million people have automatically been enrolled into a workplace pension.

Since then, it has been quite a journey: the total minimum contribution level has risen from 2% to 5% in April 2018 – comprising of 3% from employees and 2% from employers.

Steven Cameron, pensions director at Aegon, described the rule change as a “step in the right direction for increasing long-term savings”.

“However, even with April’s rise, we need to help individuals understand that contributing just the minimum amount into their workplace pension is unlikely to provide the level of retirement income they aspire to and for that, they need to consider saving more,” he added.

While the contribution increase will help people to save towards their retirement, Tom McPhail who is head of policy at investment platform Hargreaves Lansdown has warned that more needs to be done to auto-enrol the self-employed and those with multiple jobs.

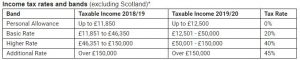

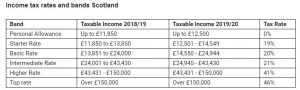

2. Changes to personal allowance and income tax rate bands

As of tomorrow, the personal allowance – which is the amount you can earn before paying income tax – is due to rise from £11,850 to £12,500. This is good news for savers who have investments outside of their ISA and pension.

This change will have a knock-on effect on income tax rates. See tables below:

Source: Aegon

Source: Aegon

For many individuals in the UK, the increase in the personal allowance will equate to an extra £650 of earnings tax-free, Aegon noted, providing a welcome boost to take-home pay.

“For those outside Scotland, raising the higher rate threshold to £50,000 means that £37,500 of income, or £3,000 more than the previous year, is taxed at the basic rather than the higher rate. An individual earning £50,000 per year or more outside Scotland will pay £860 less income tax in the coming year,” explained Cameron.

However, National Insurance will be paid at 12% on earnings up to £50,000 before falling to 2%, which cancels out £340 of the income tax saving.

3. State pension increases

The state pension is currently protected by the ‘triple lock’, which means it increases by the highest of 2.5%, price inflation or average earnings growth. Those receiving the full-rate new state pension will see their payments increase by £4.25 per week to £168.60 from 6 April. This equates to an extra £221 per year, Aegon points out.

This 2.6% increase is based on average earnings growth for the year up to September 2018, and is above the rate of price inflation for that period which was 2.4%.

While this change is good news for pensioners, Cameron points out that it is important to keep one eye fixed on changes that are coming in next year.

From October 2020, the state pension age will rise from 65 to 66. Beyond this date, it is scheduled to increase to 67 between 2026 and 2028.

4. Pensions Lifetime Allowance

The Lifetime Allowance (LTA) is the limit on the amount of pension benefit that can be built up in a pension without triggering an extra tax charge.

The LTA is currently £1.03m and is set to increase to £1.06m on 6 April, in line with the Consumer Prices Index (CPI).