The latest data from trade body UK Finance also highlighted the continuing growth trend in specialist and later-life lending, including equity release.

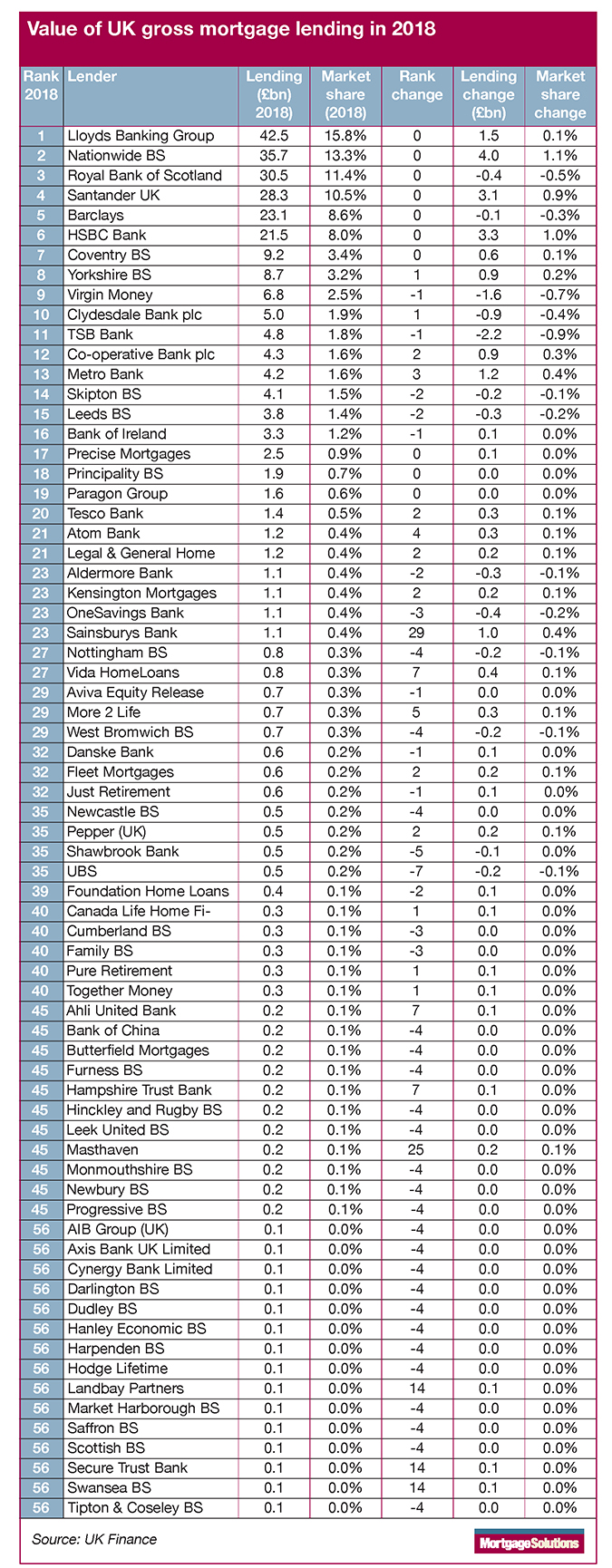

However, the big banks accounted for more than £11bn in increased lending with Lloyds Banking Group remaining the biggest lender representing £42.5bn, up by £1.5bn, with a 15.8 per cent market share.

Nationwide grew its annual lending by £4bn to £35.7bn and took a 13.3 per cent share – the second largest in the country.

Santander and HSBC also saw significant lending growth by £3.1bn and £3.3bn respectively – both more than 10 per cent higher than their 2017 figures.

Only Royal Bank of Scotland and Barclays out of the big six saw slight dips of £400m and £100m in their lending totals.

Other notable changes included TSB’s lending dropping by £2.2bn as the bank’s IT problems hit its operations, while Metro Bank and Sainsburys Bank both saw growth of more than £1bn in lending.

Competition heats-up with more lenders

UK Finance noted that while the overall mortgage market had only grown by three per cent to £268bn, there was greater competition with 70 lenders breaking the £50m barrier to be included in its data. This total was up from 60 in 2016 and 65 in 2017.

Specialist lenders saw their business grow by a combined £1.7bn, while equity release specialists accounted for £800m of growth and building societies grew by £700m.

Only mid-tier lenders saw their volumes slip, by £1.6bn.

“Specialist lenders once again saw strong annual growth,” UK Finance said.

“Patterns of borrower incomes have become more complicated, driven in part by growth in self-employment and contractor employment as well as an aging population, with more people working for longer.

“In this changing environment, lenders who have more bespoke, often manual, underwriting processes are well placed to help these customers.”

Later-life lending optimism

UK Finance noted that the best example of this was in the later life sector for borrowers aged 55 and over which saw the highest proportion of growth compared to any other sector.

It revealed that mortgages completed to borrowers aged over 55, for residential and equity release lending, had grown from 90,013 in 2016 to 121,380 in 2018.

“Lenders have seen a higher demand for mortgages from older borrowers in the last few years, extending their maximum age criteria and adapting underwriting for those whose income in later life is more complex,” the trade body continued.

“This has facilitated a competitive and expanding mainstream later life lending market.”

It added: “From these figures, it is clear that lenders are attuned to the realities of an ageing population and recognise the need to innovate in the mortgage space to provide suitable products for this expanding customer base.”