The calculator has been “designed by a broker for brokers” and has been developed to be quick and simple to use. This is a complementary service to its mainstream mortgage calculator that launched at the beginning of this year.

The new calculator will provide maximum lending amounts from over 75 buy-to-let lenders. It also includes a specialist portfolio calculator to help brokers calculate borrowing amounts for clients with more than four rental properties.

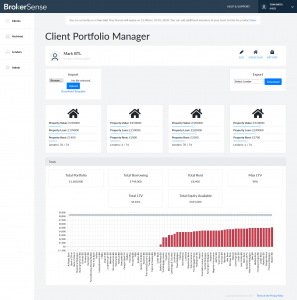

It can be used for one buy-to-let property or for clients with an extensive portfolio. Brokers with clients with a portfolio of properties, can import their clients’ multiple property spreadsheets easily including: Monthly mortgage payment, borrowing amount, property value and rental income.

The buy-to-let calculator will populate the portfolio onto the BrokerSense system. This will then display a panel for each property with a rent slider that shows how much a landlord can borrow on property but also what it will do for their portfolio. It will give them an idea of how many lenders will lend on the property and how different increases in rent will affect the amount that can be borrowed against each property.

A spokesperson from BrokerSense said the calculator will also help with compliance, showing proof of research. They said: “It protects brokers because if there are lenders that have lower rates and they haven’t placed it with them, it’ll show that it’s because the lender wouldn’t lend with them or show it’s cheaper in the long run to go with another lender.”

If the first line of the address is included, then BrokerSense will also perform a land registry search using APIs to pull in this information in seconds.

Results from the calculator will be presented as a visual overview which brokers can print off or transfer into their client CRM system.

Stuart Phillips (pictured), director of BrokerSense, said: “Our aim has been to eliminate duplication and unnecessary administration work by bringing the type of technology used by robo-advice platforms and digital advisers to the traditional mortgage broker market, helping brokers to fight the rise of the robo-adviser.”

BrokerSense did a soft launch in January of this year with its mainstream affordability calculator.

It costs £10 per month for the buy-to-let or the mainstream mortgage calculator, or £15 per month for the two. This allows for unlimited calculations.